Martingale method: a dangerous but effective method of money management. Martingale financial strategy (catch-up) View the Martingale table in dollars

Why is it the best today? free Is an online Martingale calculator for binary options, Forex and roulette considered?

What is the fundamental advantage of Proxima over other online Martingale calculators for binary options and gambling? Why do these other online Martingale calculators only focus on certain binary options and only certain types of gambling? Why can't they be used in other binary options and other gambling games? Why are these other online Martingale calculators generally not applicable to Forex and the stock exchange?

Let's look into this.

The vast majority of online Martingale calculators on the Internet are a poor imitation of real Martingale calculators. Comparing these Martingale calculators with Proxima is like comparing a Zaporozhets car with a Toyota Land Cruiser. If you learn to use Proxima, you will never use those pathetic Martingale calculators from the Internet again.

Another problem with Martingale calculators on the Internet is that most of these calculators are faulty. They calculate the Martingale sequence with errors. At the time of writing this article, all 10 first calculators in Yandex for the query "" produced in many cases the wrong Martingale sequence.

Proxima structure

The Proxima online complex consists of two parts:

- Martingale simulator

The Martingale calculator calculates the Martingale strategy. That is, it produces the result in the form of a table of three sequences of Martingale numbers:

- Martingale betting sequence

- Martingale sequence of accumulated losses

- Martingale profit sequence after the end of a losing streak

The Martingale simulator is designed to quickly test the Martingale system based on the calculated Martingale strategy.

So, the Martingale calculator has to do with strategies Martingale, and the Martingale simulator is related to system Martingale. Therefore, Proxima has, as it were, two parts, one for working with the strategy, and the second for working with the system.

Please note that the Martingale simulator does not create a ready-made Martingale system for the user. The Martingale system for testing is specified by the user himself. While the Martingale calculator calculates the most correct Martingale strategy for the user.

The strategy calculated by the Martingale calculator is correct in two senses:

- This strategy is not clearly unprofitable. After the end of a series of losses, we always earn no less than the minimum specified profit. (This means that it is already possible to create a profitable system based on this strategy.)

- Among all the clearly unprofitable Martingale strategies, the strategy calculated by the Martingale calculator is the most optimal. It has the slowest possible growth of Martingale numbers.

The second point says that the strategy found by the Martingale calculator will not be the most profitable, but it will be the most reliable among all other strategies with the same rounding and minimum profit parameters entered.

You can study Martingale theory in more detail in the book "Advanced Martingale". At the time of writing this article, this book represents the most complete universal description of Martingale in Russian.

In this article we will only introduce the Martingale calculator. We'll look at the Martingale simulator in a future article.

What is entered into the online Martingale calculator

Complete instructions for using Proxima can be found in Appendix 1 in the book "Advanced Martingale". We will not repeat the formal instructions here, but will consider the meaning of the parameters entered in the Martingale calculator.

To calculate the correct strategy in the Martingale calculator you need to enter 4 numbers:

- Profitability of the transaction

- Unprofitability of the transaction

- Martingale number rounding degree

- Minimum profit

Typically, in all other Martingale calculators that you can find on the Internet, you only need to enter 2 numbers. One of these numbers is generally redundant. That is, all other Martingale calculators only work with one number. The second number, the initial bet, is simply a multiplier by which the calculated Martingale sequence is multiplied. Well, that is, the second number is needed only for the stupidest people who don’t know how to multiply.

In fact, all other Martingale calculators only work with the trade profitability parameter. All other three significant parameters are also implicitly present there. But they are strictly defined. And the user is not told their meanings.

In fact, these Martingale calculators bias users toward a specific type of Martingale strategy. And, accordingly, to a certain type, for example, binary options or roulette games. And, in general, these Martingale calculators are not applicable for Forex and the stock exchange.

Since the Martingale calculator from Proxima uses all 4 minimum required parameters to calculate any Martingale strategy, this Martingale calculator is universal. It goes with everything. For binary options, for roulette, for Forex and stock exchange, for sports betting, etc.

Profitability of a trade in the Martingale calculator

This parameter shows what share of the capital used you will receive if the transaction is profitable.

For example, if in binary options the broker pays 80% on a profitable trade, then we directly enter the number 80 into the Martingale calculator, in the place where we need to enter “How much percent is paid on winnings.”

If in European roulette a player bets on one number, then enter the number 3500 into the Martingale calculator, since when winning bets on one number in such roulette, the winnings are in the ratio of 1:35.

Let's say on Forex a trader bought the eur/usd currency pair at a price of 1.2641 with a leverage of 1:10 so that he invested $126.41 of his money, and the purchase itself with leverage was in the amount of $1"264.10. Let's say the trader placed a TakeProfit order at the level of 1.2737 Let the commission be 5 points, that is, buying and selling a lot will cost the trader 10 points.

If the trade is profitable, the trader will earn $1"273.70 – $1"264.10 – $1.00 = $8.60. The ratio of net earned funds to own invested funds shows the profitability of the transaction. This gives a profitability of 8.60/126.41 = 0.068032592. Therefore, we enter the profitability of the transaction 6.80326% into the Martingale calculator in Proxima.

Unprofitability of a trade in the Martingale calculator

Martingale calculators that you can find on the Internet do not work with such a parameter as the unprofitability of a transaction.

This is because all these calculators were originally developed not for Forex and binary options, but for roulette and betting. That is, where the unprofitability of the transaction is always 100%. These Martingale calculators for casinos were transferred to binary options sites and declared them as Martingale calculators for binary options.

Therefore, if you need a Martingale calculator for binary options with a return or for binary options with the ability to sell the option before the expiration time, then you need to use the online Martingale calculator from Proxima.

In fact, how can you calculate the Martingale strategy using these primitive Martingale calculators if, for example, when you lose, the broker takes not 100% of your bet, but only 90%? And in the Martingale calculator from Proxima, you simply enter the number 90 in the “How much percent is lost when you lose” field.

Well, for stock traders, the Martingale calculator from Proxima is just a godsend! Let's see an example of using this Martingale calculator for Forex.

Let's say that on Forex, a trader bought the eur/usd currency pair at a price of 1.2641 with a leverage of 1:10 so that he invested $126.41 of his money, and the purchase itself with leverage was in the amount of $1"264.10. (As in the example above.) Let's say The trader placed the StopLoss order at the level of 1.2593. Let the commission be 5 points, that is, buying and selling a lot will cost the trader 10 points.

If the trade is unprofitable, the trader will lose $1"264.10 - $1"259.30 + $1.00 = $5.80. The ratio of the total lost funds to your own invested funds shows the unprofitability of the transaction. This gives a loss ratio of 5.80/126.41 = 0.045882446. Therefore, in the Martingale calculator in Proxima, we enter the unprofitability of the transaction as 4.58824%.

Rounding degree of Martingale numbers in the Martingale calculator

A bit of Martingale theory

People unfamiliar with Martingale theory generally have no idea what rounding Martingale numbers is in a Martingale calculator. None of the Martingale calculators I found on the Internet allow you to choose the rounding of Martingale numbers, except, of course, Proxima.

Regular Martingale calculators on the Internet always produce a Martingale sequence such that all Martingale numbers in it are always multiples of the very first bet.

But, excuse me, why should all bets be multiples of the very first bet? Is the minimum bet on Forex and binary options equal to one penny? Can't we use fractional shares of the first bet in future bets?

Well, have you already understood where the ears of these so-called Martingale calculators come from?

That's right, from the casino!

When you come to the casino, you exchange your money for chips. And when you leave the casino, you hand over your remaining chips back to the casino cashier and get money back in the amount of chips handed in. Therefore, you cannot bet a fractional number of chips in a casino. For example, you cannot put one and a half chips in roulette, although if the price of a chip is, for example, $1, then you can always win one and a half dollars with money without any problems.

Well, on binary options, if the first bet was $10, then why is it necessary to bet only a number of dollars that is a multiple of 10 further in the series of losses? Who forbids making bets in multiples of one dollar or even bets accurate to cents?

And the situation is the same in casinos. If a roulette player plays the Martingale strategy for one number and makes the first bet of 10 chips, then why should he make the second and third bets again for 10 chips? After all, on the second and third bets, and so on until the 25th bet, it is enough to bet only 1 chip in order to earn at least one chip when you win. One chip is 0.1 of the initial bet.

And if a player wants to earn at least 8 chips from winnings, then in a series of failures from the second to the 7th bet it is enough to bet only three chips. If a player wants to earn at least 20 chips on a winning deal, then after the first loss of 10 chips, only 6 chips are needed for the second bet, and only 7 chips are needed for the third.

Martingale theory explains why Martingale roulette calculators do not work with fractional rounding of Martingale numbers. The reason is very simple. Roulette has a negative expected value and there is no correlation between successive results. Therefore, you can hold out for the final series of bets only by taking the minimum ratio of the starting bet to the starting capital and to the maximum allowed bet.

This ratio will be minimal only if the starting bet is equal to the minimum chip. Therefore, it makes no sense for a casino to create a Martingale calculator with the ability to set different options for rounding Martingale numbers. Because it is no longer possible to split the minimum chip.

But for binary options and Forex, everything is no longer the same. Minimum lots and minimum bids do not consist of one cent or one kopeck, which cannot be split up. Minimum lots and minimum bids consist of a large number of cents, kopecks, dollars and rubles.

And the Martingale theory states that the more finely rounded Martingale numbers are used in the Martingale calculator, the more reliable the Martingale strategy is calculated by the Martingale calculator.

Rounding examples

Proxima has 4 options for rounding Martingale numbers:

- Up to a whole number

- Up to tenths

- Up to hundredths

- No rounding

Rounding to the nearest whole number means that the Martingale calculator calculates all Martingale numbers as multiples of the first bet or the size of the first trade. For example, if the first bet on binary options was $1, then all other bets will be in the form of an integer number of dollars.

Another example with Forex. If in Forex the first trade was for equity capital of $126.41, then all other trades will be proportional to this number. For example, if the TakeProfit and StopLoss levels keep the profitability at the level of 6.80326%, and the unprofitability at the level of 4.58824% (as in the examples above), then to get a profit of at least $8.60 for each win, bets should increase according to the principle: 1, 2, 4, 6, 10, 17, 28, ... For example, the fifth trade should be 10 times larger than the starting trade, that is, for the fifth trade you need to use $1"264.10 of your capital using this Martingale strategy.

Rounding to the nearest tenth means that the Martingale calculator calculates numbers to the nearest tenth of the first bet. For example, if the first bet on binary options was $1, then subsequent bets may contain tenths of a dollar.

Let, for example, if you lose, the entire bet is lost, and if you win, you earn 80% of the bet. If we want to earn a minimum amount of money with each win, for example, 0.8 of the size of the first bet, then the correct Martingale calculator gives the following sequence of bets with fractional numbers:

1, 2.3, 5.2, 11.7, 26.3, ...

Again the same example with Forex. To make a profit of at least $8.60 for each win, the correct Martingale calculator shows that the capital in transactions should increase according to the principle:

1, 1.7, 2.9, 4.8, 8.1, 13.5, 22.6, ...

For example, the fifth trade should now be not 10 times larger than the starting trade, but only 8.1 times, that is, for the fifth trade you need to use $1,023.92 of your capital using this Martingale strategy.

Rounding to the nearest hundredth means that the Martingale calculator calculates numbers to the nearest hundredth of the first bet. For example, if the first bet on binary options was $1, then the next bets may contain hundredths of a dollar, that is, cents.

Suppose that if you lose, the entire bet is lost, and if you win, you earn 80% of the bet. If we want to earn a minimum of 0.8 of the size of the first bet with each win, then the correct Martingale calculator gives the following sequence of bets:

1, 2.25, 5.07, 11.40, 25.65, ...

And again the same example with Forex. To make a profit of at least $8.60 per win, a good Martingale calculator gives the following capital increase per trade:

1, 1.68, 2.81, 4.71, 7.88, 13.20, 22.10, ...

For example, the fifth trade should now be not 10 times the starting deal and not 8.1 times, but only 7.88 times. That is, for the fifth trade you need to use $996.11 of your capital using this Martingale strategy.

Minimum profit in the Martingale calculator

A little more Martingale theory

Finally, all Martingale calculators except Proxima do not have the ability to calculate a strategy taking into account the minimum profit after the end of the account drawdown in a series of losing trades.

The fact is that after the series of losses has ended, we must earn something in a profitable trade. Neglecting this point in defining the Martingale strategy is costly for the user.

If after the end of the account drawdown you do not earn anything or are even in the red compared to the account state before the drawdown began, then this is the wrong strategy. This is clearly a losing strategy. As you know, it is impossible to create profitable earning systems based on clearly unprofitable strategies.

That is why in the definition of the Martingale strategy there is a special clause that says that after each profitable transaction, not only compensation for the entire total loss on the previous losing series should occur, but also a profit should remain not less than the specified minimum profit.

Errors in Martingale calculators

At the beginning of this article it was already said that at the time of writing this article, all 10 of the first Martingale calculators that Yandex produces in its search results upon request " Martingale calculator", are erroneous. Their mistake lies precisely in completely neglecting the definition of the Martingale strategy. The developers of these Martingale calculators apparently did not know that in the Martingale strategy you must ALWAYS earn money after the end of the account drawdown. And this earnings must be no less than some minimum earnings .

If the developer of such a Martingale calculator understands this, then he should indicate this minimum profit that can be guaranteed to be obtained after the end of a series of losses. And the Martingale sequence produced by the Martingale calculator must strictly adhere to this rule, that is, after the end of the drawdown, it must produce a profit no less than the specified one.

And what do we really have? For example, I take one of these online Martingale calculators and set the initial bet to 1, and the profitability to 80%. (As mentioned above, the loss ratio in such Martingale calculators is taken only as 100%, and rounding is done only to the whole number of the initial bet.) The site says that after the end of losses, earnings will supposedly be the same as if they had placed the initial bet. (Many sites, by the way, don’t even write this.) Since the initial bet is 1, it means that after the end of the series of losses you should earn 0.8.

And so, this unfortunate Martingale calculator produces the following nonsense:

1, 2, 5, 11, 25, 56, 126.

While the Martingale calculator in Proxima for the same parameters produces the following sequence:

1, 3, 6, 14, 31, 70, 158, ...

Do you feel the difference?

The difference started already on the second bet! Let's check this Martingale calculator to see if it calculates the sequence correctly. Let's say you lost on the first bet, and won on the second. If you put 2, then 80% of 2 gives 1.6. But they lost on the first bet by 1. This means that there is only 0.6 left in profit, and not the promised 0.8.

What does this seemingly small error mean? It says that the developer of this Martingale calculator did not include in the algorithm the rule not to reduce profit to a level less than a given minimum profit level. This means that you cannot use such a Martingale calculator.

Such a would-be Martingale calculator can produce the wrong strategy, which is clearly unprofitable. And it is impossible to create a profitable trading system based on clearly unprofitable strategies. You will lose both money and time.

Therefore, use only normal Martingale calculators, such as those in Proxima. There you set the minimum profit you want to receive. And the Martingale calculator gives you a whole Martingale table as a result, in the last line of which you control the amount of profit after the end of a series of losing trades.

Entering the minimum profit into the Martingale calculator

In Proxima there are three ways to set the minimum profit after a drawdown:

- Base rate

- Basic profit

- Your number

The base rate is one. The Martingale calculator calculates a sequence such that after a drawdown you earn at least 1. For example, if you need a sequence with rounding to a whole number of bets, with a profitability of 80% in a trade and a loss of 100% in a trade, we get the following sequence:

2, 4, 10, 22, 50, 112, 252, 568, 1278, ...

Pay attention to the last column in the resulting Martingale table when using the Martingale calculator. There, nowhere after the end of the drawdown do profits become less than 1.

Basic profit is when, on the contrary, the profit must not be less than 1, but the profit must be no less than the profit that is obtained with the starting bet. In our example, if the starting bet is 1, then the base profit is 0.8. Therefore, the Martingale calculator calculates the sequence of Martingale numbers in our example such that after a drawdown we will always earn at least 0.8 of the starting bet.

And finally, the user of the Martingale calculator in Proxima can enter any number greater than zero as the minimum profit. This number is entered in base units. For example, if you enter 1 into the Martingale calculator, you get the same result as for the “Base rate” option. And if we enter the number 0.8, then for our example with a profitability of transactions of 80% we will receive the same sequence of Martingale numbers as for the “Basic profit” option.

Additional Notes

The Martingale calculator in Proxima is not just a powerful tool for constructing the correct Martingale strategy, in full accordance with the Martingale theory.

Due to the fact that the final result of the calculation is presented in the form of a Martingale table, this Martingale calculator allows you to have good control over the results of the calculations. While other Martingale calculators work “in the dark” and give the user a pig in a poke.

Thanks to this presentation of the calculation result by the Martingale calculator in Proxima, users can easily experiment with it and quickly learn how to work with it. After mastering the free Martingale calculator in Proxima, not a single person will use other defective and castrated Martingale calculators.

Conclusion

So, let’s list all the advantages of the Martingale calculator, which is built into the free online program Proxima:

- Versatility. The Martingale calculator can be used not only for roulette and some binary options, but also for all binary options, for Forex, for the stock exchange and for sports betting.

- Correctness of calculations. The Martingale calculator does not have mathematical calculation errors.

- Practicality. The Martingale calculator uses a variety of rounding degrees for Martingale numbers that may be required in practice.

- Complexity. The Martingale calculator in Proxima is combined with the Martingale simulator, so the user can immediately set up his Martingale system based on the calculated Martingale strategy and immediately test it within a few seconds.

- Portability. Anyone can.

If you are offered to use the Martingale strategy to make money, then study the Martingale theory (for example, the book "Advanced Martingale") and use only the correct Martingale calculators (for example, Proxima). If you don’t want to do everything correctly, then don’t use Martingale.

Binary options trading is considered a highly effective type of online work in the era of the development and spread of the Internet. However, it entails high risks that are associated with daily asset price movements. In such a situation, various programs and methods that simplify trading calculations can help.

One of these assistants is the online martingale calculator for binary options. Let's consider the features of its application in this article.

Main settings

The probability of making a profit in any of the options is 50%. As a result of using the calculator, the trading participant receives a profit that covers losses during unprofitable trading. The main caveat of using such a program is that the player may ultimately not have the funds to open new transactions.

It can be difficult for a financial market participant to determine a specific amount of profit that will compensate for his losses. The binary calculator correctly calculates the lot and depot size at any stage of the purchase. In such a situation, the trader enters the following data in specific fields: the amount of the minimum investment and the profitability in%.

The result of the calculations is a sequence of bets with increased values. So, if the initial deposit amount is $10, and the probable return is 50%, then the calculator shows the following rates: 10; -10; 10; -10; 10; -10; 10. Using this program does not cause any difficulties. When calculating the increase in transaction volume, you need to enter the value of 1 bet and the % of money won.

This tactic covers losses. Each subsequent position, after a failure, increases so much that it eventually covers all losses from previous losses and makes a profit. When using this method, you can receive a certain amount of funds for a long time and not go into losses.

However, the player must always have a specific deposit amount in order not to lose money on several losses in a row. Of course, in theory this works, but in practice, the deposit may simply not be enough to open a new position with an increased lot.

The Martingale trading method is used to compensate for losses from failed transactions. The goal of the calculator is to ensure that the income from each unprofitable contract covers the serial loss and at the same time brings 1 profitable bet.

According to mathematicians, such a strategy can take place, but one must keep in mind all the risks. After all, the price of an asset, for example, a currency pair, rises very sharply and quickly, and you can even miss the moment when the account is reset to zero.

As a result, before using such tactics, you need to calculate in advance what kind of losing streak the trader’s method will bring. Let's look at an example:

- the amount of the initial deposit (for example, $100);

- % of income (for example, 80%);

- the maximum length of a losing streak based on the results of a history test (for example, 5 trades).

So, the smallest risk is $100, profit is 80%. 1 contract of the series is always opened with the least risk. If the forecast is correct and the lot is closed in money, the next bid is made in the same amount.

If a loss is received, the value of the option must match the next one - $225. In such a situation, if the contract is closed in the money, the market participant receives $180, and minus the losses from 1 bet, the net income is $80.

Afterwards, the trader buys the contract again at the minimum position. As a result, in each transaction there is a calculation to receive a net profit in the amount of the payment from the minimum contract, in our case $80. If the deposit is not limited, then this strategy is considered break-even. Naturally, no player has an endless deposit.

As a result, for such a system to work effectively, each series should have no more than 3 contracts. This means that the longest losing streak at the test stage does not exceed more than 3 trades in a row.

Martingale table

When trading using such a calculator, a financial market participant knows in advance the percentage of income after a successful transaction. Usually it is 70–85%. Below is a visual martingale table for binary options, which shows the calculation where the profit percentage is 80. To close a losing contract, the trader raises the next bet by the percentage deduction (in this case, 0.8).

With the 1st serial position being 1 dollar, the next position is equal to 1:0.8=1.25. If it turns out to be winning, the income will be = 1.25+1 = 2.25. As a result, the financier closes the amount of both 1 and 2 orders, reaching the break-even level.

In such a situation, the user does not receive income, but does not lose his deposit. Next, by making the calculation using the formula, you can get a table of the values of the following orders:

| Bid No. | Rate ($) | Accumulated loss ($) | Expected winnings ($) |

| 1 | 1 | 1 | 1,8 |

| 2 | 1,25 | 2,25 | 2,25 |

| 3 | 2,82 | 5,07 | 5,076 |

| 4 | 6,34 | 11,41 | 11,41 |

| 5 | 14,27 | 25,68 | 25,69 |

| 6 | 32,1 | 57,78 | 57,78 |

| 7 | 72,23 | 130,01 | 130,01 |

| 8 | 162,52 | 292,53 | 292,54 |

| 9 | 365,67 | 658,2 | 652,21 |

| 10 | 822,75 | 1480,95 | 1480,95 |

It shows that with 9 losing contracts, the trader loses $658.2. And in the case of the 10th step – $1480.95. At the same time, he earns nothing.

Below is a detailed martingale table for binary options in rubles, calculation of a bet with a nominal value of 30 rubles. and with a winning rate of 85%.

| Rate (RUB) | Depot size (RUB) |

| 30 | 30 |

| 36 | 66 |

| 78 | 144 |

| 170 | 314 |

| 370 | 684 |

| 805 | 1489 |

| 1752 | 3241 |

| 3813 | 7054 |

This table shows that at break-even levels, a position with a nominal value of 30 rubles. and with a winning of 85%, the trader already at the 7th stage makes a lot 100 times larger than the initial one, and at the 8th step - 200 times (!). And then the rate of increase increases at a very fast pace. Already for the 8th lot you need a starting deposit of 7055 rubles - and this happens for break-even positions. If the player increases the 2nd bet in order to make a profit and cover losses, then the remaining lots will also increase.

When to use?

This system is very dangerous to use, because with high risks, your lot must be increased by at least 2 times. As a result, players use such tactics only in conjunction with technical analysis. Let's say a trader carried out an analysis and came to the conclusion that the EUR/USD currency pair will rise, but his trade ended up losing because he set the wrong expiration date for the asset. However, his prediction remained correct.

In such a situation, a financier can use such a trading system, recover losses and make a profit. At the same time, it is better not to trade using this system in the following situations:

- when the trading session opens in the US and Europe. During this period, great volatility arises, which often defies logic;

- you cannot trade against trends;

- before important news from the financial calendar begins to appear;

- if a market participant has a small depository.

In general, this tactic is successful - it covers losses with income from 1 transaction. With a stable trend or when using a specific system, the player completes contracts with a profit in the 1st stages of increase. But is the user ready for this?

To make a profit of $24, a trader must have a deposit of at least $5,000. Having such a deposit, he wants to earn a greater profit than $16.8 (70% of $24). Also, opponents of this know that in the future there will be an inevitable loss of the deposit, since the losing streak is not limited by anything.

Analysts say that if you remove technical analysis and use only the Martingale system on pure assets, the 1st deal can be closed with an income of 57.4%, the 2nd - 79.1%, and the 3rd - 98 ,9%.

Deciding whether to use Martingale tactics on binaries or not is everyone’s choice. Traders often consider Martingale to be a certain standard of fairness that takes into account all risks. In this case, a binary options calculator is the best tool for successful players who are ready to take risks and get bigger profits.

Binary options are one of the promising areas for making money on the Internet, allowing you to open the door to the world of financial independence. However, work in this area is associated with risks due to asset volatility. To achieve stable earnings, a trader must competently manage his capital, follow the rules of money management and not neglect the tools that allow him to optimize settlement operations. One of them is the Martingale calculator. What is this tool and how to use it?

The Martingale calculator for binary options is intended for traders who use a strategy based on the design of a grid of orders in their trading. The tool allows you to determine the size of a trading account that would withstand a drawdown when working using the trading system of the same name. With its help you can calculate the volume of orders and their number.

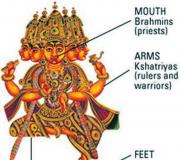

Figure 1. The essence of the Martingale trading system

Binary options trading is characterized by difficulties expressed in the lack of funds necessary to conclude a new transaction. It is difficult to calculate on your own how much you need to bet in order to compensate for losses from previous periods and make a profit. Using the calculator it becomes possible to determine:

- comfortable deposit amount;

- the lot size that activates the transaction.

To obtain this data, you must enter the following information in the fields of the calculator:

- expected return parameter;

- the minimum amount of money that a market participant is willing to deposit into the account.

The Martingale calculator can be downloaded from websites specialized in the field of binary options. Alternatively, all calculations can be done online.

Executing settlement transactions on the Martingale system calculator does not cause any difficulties for anyone, since the procedure is intuitive. To calculate the volume of bets that increase after fixed unprofitable transactions, you must enter the following information in the instrument form:

Figure 2. Online Martingale calculator

The Martingale online calculator will help increase the profitability of a trading strategy, provided that traders identify the instrument as a kind of mathematical model that takes into account all risks. It is indispensable for binary options market participants who work using grid strategies.

Calculations depending on profitability

The size of bets is directly dependent on the profitability indicator per transaction. It is determined by the terms of the contract when purchasing the option. The parameter is required when filling out the calculator form.

The first transaction is characterized by the least risk. The rates do not increase. If the option transaction is profitable, then it is recommended to execute the second transaction with the same volume. In case of a loss, you will have to increase the lot to compensate for the losses and have a small income. After working off losses, it is recommended to draw up a contract with a volume corresponding to the first transaction. The program contains the principle of making a profit in each transaction in the amount regulated by the terms of cooperation with the broker in the form of a percentage calculated from the profit received on the previous option.

The online Martingale calculator for binary options is actively used by players of any skill level. The software interface is intuitive, so its use does not cause any difficulties. However, they can arise at the stage of working on the strategy if the trader uses it as the main element of the trading system. In the calculator settings, it is not recommended to set more than 3 trades recorded as unprofitable, especially when used by beginners.

Advantages and disadvantages

The profitability of the Martingale strategy has been proven and mathematically justified. Each of her losing trades requires doubling her bet to compensate for the previous loss and to make a profit.

The advantage of using the Martingale table is the simplification of the settlement operation. The mechanism for implementing the strategy is simple and can be implemented even by beginners.

Figure 3. Providing results upon request

The disadvantages of the system include:

- high probability of successive losses;

- the need to invest a large amount;

- the risk of losing funds invested in a trading account.

Tips for using the Martingale calculator

When practically applying the Martingale method as the basis of a trading strategy used in the field of binary options, a trader can suffer five losing trades in a row. For this reason, it can only be used if there is a large deposit, the parameters of which should be calculated in advance using a calculator.

Figure 4. Filling out a request in the Martingale calculator

After entering the appropriate data into the instrument columns, the program will display the steps for increasing the amount.

When working with binary options, a trader has the opportunity to quickly make money and cover losses. However, in order to achieve a stable income, he needs to invest a considerable amount of money. Without experience and practical skills in determining the direction of a trend, you can bet against it, which will certainly cause a loss of investment. The Martingale method in binary options is not recommended to be used in its pure form. Professional players combine it with various analysis methods.

Figure 5. Martingale table

When using a calculator in the Martingale method, you should adhere to a number of rules:

- the bet amount should not exceed 1 percent of the trading account size;

- during the period of publication of economic news and political events, which are characterized by increased market volatility, it is not recommended to trade using the method;

- the amount of the maximum possible loss must be fixed by the trader in his own strategy, as a result of which he should not enter into contracts on the day on which the regulations were exceeded;

- attention should be paid to the quality of transactions, not their quantity;

- It is necessary to prepare in advance for bets on large amounts in order to cover losses.

Results

The Martingale strategy in the field of binary options can only be used as a tool with which you can manage risks. Using it as an element of a trading system is unacceptable, since such a decision will certainly cause the deposit to be drained. The strategy can be used in conjunction with another system, which is characterized by a small drawdown and the absence of consecutive losing streaks.

In its pure form it is risky, but if used wisely it can become profitable. To do this, the main signal must be associated with deep market monitoring, based on the readings of various analysis tools. Using the Martingale calculator will help you effectively use the grid strategy as a filter for making relevant decisions regarding the execution of an option order.

Recently, due to exchange rate fluctuations and the total strengthening of the dollar, ruble accounts for binary options are gaining more and more popularity. It must be said right away that there are quite a few brokers who provide the opportunity to open ruble accounts, and you yourself impose an unnecessary restriction on yourself by being tied to a ruble account. For successful trading and making a profit, it is not the account currency that is important, but the capabilities of the trading platform. I will write more about what you need to pay attention to when choosing binary options trading in one of the following posts.

Now I'll look at examples of martingale calculation for 30 rubles and 100 rubles, I'll show you how to independently calculate the martingale step for rubles and what pitfalls may await you.

An example of a martingale for a 30 ruble bet with a payout of 85%.

| Bet size (RUB) | 30 | 36 | 78 | 170 | 370 | 805 | 1752 | 3813 |

| Deposit amount (RUB) | 30 | 66 | 144 | 314 | 684 | 1489 | 3241 | 7054 |

As you can see, calculating the Martingale steps according to the “break-even” levels (in the case of a successful transaction, we recover from a loss, without profit) and with one of the highest bets of 85%, already on the 7th step we are forced to place a bet 100 times larger than the starting one, and on the eighth more than 200 times (!). And then the rate of increase in the rate will grow at a cosmic pace... think about it. After all, for the eighth bet you need a starting deposit of 7055 rubles. And this is only at the “break-even” levels - if you increase even the second bet in order to earn money, and not just cover the loss, then the next bets will also increase.

An example of a martingale for a 100 ruble bet with a payout of 80%.

| Bet size (RUB) | 100 | 125 | 282 | 634 | 1427 | 2639 | 5938 | 13360 |

| Deposit amount (RUB) | 100 | 225 | 507 | 684 | 2111 | 4750 | 10688 | 24048 |

All calculations are the same as in the example with a 30 ruble rate.

The bet size is the amount of the next transaction after the loss of the previous one.

Deposit amount – the required amount of the initial deposit to be able to complete the transaction. How much money do you need, in simple terms? This same amount is the total loss in the event of a negative transaction result.

How to calculate the martingale step for binary options in rubles yourself.

The principle of calculation itself is quite simple, the main thing is not to get confused in the numbers. To do this, I recommend taking a pen and paper and drawing it into two parts, one containing the “bet amount” and the other “deposit amount”.

We immediately write the first bet, for example 50 rubles. We write the same amount as a deposit. Since we have the first bet, the spent deposit is equal to the first bet.

| Deposit | Bid |

| 50 | 50 |

In case of loss, you need to increase the next bet by the amount of the percentage deduction. If we have an option with a deduction of 85%, then we divide the deposit amount by 0.85 (50:0.85=58.8), round up and get 59 rubles.

We have the following bet of 59 rubles.

The deposit amount is the sum of our bets. At the second step it is equal (in our example) 50+59=109 rubles.

The next bet is 109:0.85=129 (including rounding)

The next deposit is 109+129=238 rubles.

| Deposit | Bid |

| 50 | 50 |

| 109 | 59 |

| 138 | 129 |

I think the principle of calculation is clear?

I recommend keeping all calculations and notes on a piece of paper, this will help you avoid getting confused and lost. After all, the transaction amounts may change if you sold a binary option ahead of schedule or moved it to another time... it’s very easy to get confused throughout the day.

And some food for thought...

If we lose five times with a fixed bet of 100 rubles, we will lose 500 rubles. To restore the deposit balance, 6 successful transactions are enough and the 7th will close the balance and bring us about 60 rubles in profit on top. With martingale, under the same starting conditions, we will lose 2111 rubles (table above) and to recover we will need 26-27 transactions of 100 rubles each (!).

05.06.2018 14:14

The method is that you choose the size of the first bet, fix it, and then, in case of loss, increase the size of the bet so that the next bet covers both the loss from the first bet and the second bet. Further - in increasing order. If you win, the series is “reset to zero” and you start betting again from the first bet. The obvious disadvantage is that the bank requires a fairly large reserve of the gaming budget.

Example. We bet on the outcome of a football match Even/Odd (the estimated probability of this outcome is 0.5 or, simply, 50/50). Some average bookmaker gives odds of 1.8 for this event. The series of bets with the first bet of $1 will look like this:

- 1 bet - $1

- 2nd bet - $3.25

- 3rd bet - $8.31

- 4th bet - $19.70

- 5th bet - $45.33

- 6th bet - $103.00

- 7th bet - $232.74

- 8th bet - $524.67

- 9th bet - $1181.51

This calculation includes the winnings from each bet step. So, if the win occurs on the 1st bet, the winnings will be $0.8. If on the 2nd - $1.6. On the third - $2.4. If you win on the 9th bet, you will earn a total of $7.2. Moreover, in order to reach the 9th level, you will have to lose the previous eight, which, you see, is quite nerve-wracking. In addition, if we talk about the ratio of funds won to bets, the proportion at level 9 is also not the best: 7.2/2119b5=0.0034 or 0.34%.

Is it possible to reduce risks when betting using the Martingale system?

Can. Here are some ways:

- start the series with small bets; in our example, the initial bet can be reduced by 10-20 times;

- pledge your winnings only at the first levels, then reduce your profit to zero in order to use a smaller bank to quickly return to the first level;

- bet on events with high odds. In general, the higher the coefficient, the slower the rate growth will be with each subsequent level. So, in our example, if the odds were not 1.8, but 1.91, then at level 9 we would receive a bet of $631 (instead of $1181) and the total amount involved would be $1,200. Just by increasing the coefficient by 0.11, we got an almost twofold reduction in the total budget.

How to include zeroing of the working bank in the mathematical model?

Since one of the features of the Martingale system is the periodic reset of the working bank, it would be advisable to initially plan for this development of events in order to come out with a profit in the long run. How to do it?

Not difficult. If more than a one-time increase in the bank takes place before the calculated drain of the bank, such a model can already be considered winning. This means that if the starting bank increases by 1 or more times (for example, twice), after which it is scheduled to be reset to zero, then such a scheme will still bring profit to the player.

The simplest example:

Starting bank $100.

With the help of Martingale, we triple the bank every cycle and work on half (to be on the safe side) of the budget. This will give:

- 1st cycle: win $150, lose $50. In the bank - $100 + $50 = $150 (take half for the next cycle, i.e. $75)

- 2nd cycle: win $225, lose $75. In the bank - $75 + $150 = $225

- and so on.

Is Martingale evil?

Among the majority of players working with sports betting, there is a fairly persistent myth that claims that betting on this system inevitably leads the player to a complete (and very bitter, whatever) loss of the bank. The statement is not indisputable, we will explore this below, but it has a right to exist. Moreover, probably everyone who begins to somehow systematize their own bets, that is, is already engaged in professional betting, has encountered this same zeroing of the working bank.

And, despite this, Martingale’s financial strategy, unlike the players, has changed for hundreds of years. Invented in the 18th century (and according to some sources, even earlier), the strategy continues to capture the minds of players trying to find their own version of its implementation in one form or another. Isn't this strange? If the strategy had been completely worthless, wouldn’t it have sunk into oblivion two hundred years ago?

With this article I would like to tell and analyze the Martingale system from the inside in simple understandable language. Look at the pitfalls and, more importantly, identify ways that can help the player use the strategy to his advantage.

There are not many facts indicating the truth of the statement: “The Martingale system is an absolute evil,” but they are weighty:

- There is rigorous mathematical proof that the classic use of the Martingale system on an infinite number of bets inevitably leads to zero winnings. In other words, the player ends the series with exactly the same bank with which he started.

Conditions: toss (probability of heads/tails = 0.5), we always bet on heads, and if we lose, we double. There is an initial capital that can be enough for a series of (\displaystyle n) bets (that is, the size of the initial bets).

Probability of ruin: . Probability of winning:.

Now, for example, in numbers: the initial bet is 1 dollar, there is a capital of doubling bets, that is, a dollar.

The result of 10 throws can be anything: there can be all tails, there can be all heads, there can be 5 heads, then 5 tails, there can be 5 tails, and then 5 heads, etc., all combinations are possible. All these combinations are equally probable, and the probability of each of them is equal. Moreover, of all possible combinations, only one will lead to ruin: 10 heads, that is, the probability of ruin is equal to .

The probability of winning, that is, of any other combination except ten heads, is equal to . The ratio of the probability of ruin to the probability of winning is equal.

The possible winnings in a series are $1. In this case, the player risks his entire capital equal to 1023 dollars, that is, the ratio of win to risk (1:1023) is equal to the ratio of the probabilities of ruin and winning. If you play a large number of series in a row, then on average every 1024th series the player will lose, losing all the winnings from the previous 1023 series, and in the end, on average, will remain with his own. The mathematical expectation of the game is 0.

- Real strategy development requires an initially high gaming bank. If you bet on candy wrappers, that is, without making real bets, the sense of reality is lost, bets are not placed as carefully as in a real game.

Having been systematically involved in sports betting for a long time, we are opponents of such a virtual game (known as the “candy wrapper game”). With the exception of mathematical modeling, which in most cases can fully replace the practice of long series of bets. The introduction of any conventions into the game usually leads to the fact that the player, and we are, of course, talking about a professional player, ceases to pay attention to the minor but important nuances of the game, which often determine its character: winning or losing.

The following factors can be listed for using the system:

- Using the system significantly increases the likelihood of winning in the short term.

- The system, being correctly calculated, allows the player to build game schemes of almost any complexity and duration.

We remind you that a gaming scheme is a combination of different types of strategies and/or methods of playing with bets. For example, gaming strategy + financial. And so on.

- The Martingale strategy fits perfectly with most gaming strategies and playing methods. Moreover, most gaming strategies initially involve catching up

“Dogon” is often called the Martingale system. Wrong. Martingale is not a “catch-up” strategy in all cases; the system is much more flexible.

- Easy to understand and implement.

- The ability to calculate and put into practice with high accuracy seemingly incalculable probabilities of sporting events. We focus your attention on this point; below we will look at an example illustrating this thesis.

Based on the above theses, it can be argued that:

The Martingale system is a reference progressive strategy.

Continued use of which, however, can do a disservice to the player by zeroing out his bank. Working with the system requires a more flexible approach; it’s definitely not worth working with it head-on.

What is the potential of the system? Let's look at a live example.

We take an event with an expected probability of outcome of 87.5%.

How to take such an event? - No answer. But below we will show that this is possible using the Martingale system

It is not possible to find such an event, so we will make the choice from the opposite, from the odds that bookmakers give for such an event. And here, attention! The coefficient, depending on the bookmaker (high or low margin) varies from 1.01 to 1.08.

How did we know this? It’s very simple - from the table of correspondence between probabilities and coefficients.

Any professional player will tell the price of a bet on any of these odds. After all, and this is not a rare situation, events for which such insignificant odds are set are underestimated by the bookmaker. There are many factors for this, and this is not at all a desire to cash in on simpleton players (although not without this, of course), for example, such a factor could be shoulder overload in bets on the favorite or on the most expected outcome.

So, on one side of the scale, bet on odds ranging from 1.01 to 1.08, depending on the bookmaker.

On the other side there are three bets on an equally probable event (probability = 0.5 or 50%, bookmaker odds from 1.85 to 2.02), which, unlike any other probability, is not difficult to find, at least one of which must win . Why is that? Very simple: 0.5^3 = 0.125 is the probability of losing. Winning will happen with a probability of 0.875 or 87.5%. As in the first case.

What would you bet on in this case?

Of course, in the above example, betting on a low odd (it doesn’t matter so much whether it’s 1.01 or 1.08) will be the most illogical. After all, the probability of losing is very high. And a winning of 1-8% of the bet amount is not high enough. A series of bets using the Martingale system with the same bank will give about a 9% increase if you win at any level.

The Martingale calculation is quite simple, but if you don’t calculate quickly, you can use the Martingale system calculator or mathematical modeling table, it also has a built-in calculator.

And the main conclusion from here: with long-term development, the Martingale system will show better results than just a series of bets on low odds.

And here a contradiction emerged: in fact, the Martingale system can show better results than regular bets in the long term. The main thing is to work not with the whole bank, but by distributing it.

But a better result does not mean a winning one. In principle, you can reset the bank in one or another way. After all, the bookmaker’s margin still reduces the final odds, which means you need to somehow get around this. Perhaps the Martingale system will help with this too?

Before considering this, I would like to dwell on perhaps the main characteristic of the system:

The Martingale system, while not absolutely winning, allows you to redistribute winnings and losses over time, from bet to bet.

Using this property, you can manage your income by incorporating inevitable losses into the gaming system. So that the sum of winnings is always greater than the sum of losses.

When carrying out preparatory work for developing a particular strategy, a professional player must always calculate the probabilities of all events expected in the game cycle. If there are N events in a cycle, the probability of each of which is 0.5, then the probability of a series of two such events occurring is almost 1 (that is, almost 100%), but the probability of a series of 8 events in a row is less than 0.4%. This means that when working over a long distance, a player can expect 4 losses per 1000 bets (which is the same 0.4%) or 1 loss per 250 bets. And here we are not talking about losing one bet, but about losing a series of bets, that is, when the Martingale system “resets” the bank. But with a preliminary calculation, this zeroing will be insensitive to the player if he initially calculated everything.

This means, in turn, that having lost once out of 250 series, in the remaining 249 series the player must earn more than the amount of his working bank in each series. And here a huge variety of work options opens up: you can work flat (talking about equal amounts of working banks), or you can make Martingale-in-Martingale, increasing the amount of the working bank to work out further series. These are just two of the many options available to the player.

Everything described above is a study of Martingale itself. But we must not forget about the flexibility of this strategy, its ability to be combined with other strategies. After all, in essence, the Martingale system is just a principle, following which the player moves his winnings in time. So why not move it so that you win a lot and lose a little? A principle similar to this idea is used in the Dynamic mathematical advantage system, for example.

What conclusions can be drawn?

- The Martingale system is not as scary as is commonly believed.

- At the same time, using it directly for a long time, without any safety options, will most likely lead the player to a disadvantage. This use of strategy is very common among those new to sports betting.

- The flexibility and ease of operation (calculations and bets) using the Martingale system are among the best among all existing systems. This is especially convenient when carrying out calculations before starting to work out game series.

The statement that Martingale is evil seems to us somewhat ill-considered and even sweeping. The fact that many players have lost money using this system does not make it bad. Just like a bad car does not make its driver bad. The Martingale financial strategy is one of the most effective and progressive (here from the word progress) tools for working with bets. You just need to work carefully and not neglect preliminary calculations.

Strategy mechanics

The idea of the Martingale technique is based on the dependence of the size of the next bet on the outcome of the previous one. Initially, the algorithm of actions is not much different from the classic uniform “Flat”. The gaming deposit is divided into equal parts. Usually they try to bet with a small percentage. It could be 1% or 2-3%. If you have a very large bank - a fraction of a percent. If the first bet wins, then they continue to bet the same fixed amounts. If it loses, then the size of the second step is increased in order to cover the sum of the first and second iterations. If the second move turns out to be winning, then they return to the original bet size. If there is a second loss in a row, they continue to increase. There may be options here. You can increase it in order to evenly win back the size of the first call, or you can also include profit. Let's look at this with examples.

Initial deposit: 100,000 rub. First bet amount: 100 rub. or 0.1%. We will bet on the average odds of 2.00. If a series of losses begins, then each next entry we will increase in order to win back the amount of previously lost steps. We don’t count profits on moves beyond the first.

- 100 rub.

- 100 rub.

- 200 rub.

- 400 rub.

- 800 rub.

- 1,600 rub.

- 3,200 rub.

- 6,400 rub.

- 12,800 rub.

- RUB 25,600

At this stage, we have already lost more than half of the deposit, namely: 51,200 rubles. Having bet the entire balance of 48,800 in step 11, we will not even cover the previous loss completely. If we lose this move, we will reduce the score to zero.

All the advantages and risks of the described algorithm are obvious. It is quite rare for such a huge series of losses to happen. With a high-quality approach to forecasting and selection of events, you should not allow a series of 10 losses in a row.

The equality of entries 1 and 2 should not be surprising. Having lost on the first step, we bet the same 100 rubles on the second. If we win, we will return the amount of both bets and can start again.

Entry 3 is already being increased to 200 rubles. Having won on this move, we will receive 400 rubles, having won back the money of the first two moves and compensated for the third. And so on. As you can see, with such initial ones, the deposit will be enough for 10 iterations. Well, or 11, taking into account the last inferior move by the rest of us.

Despite all the apparent reliability (I will never make 11 losses in a row!), we must understand that at step 10 we are risking a quarter of the bank just to win back previous losses and not make a profit at all.

Let's consider an example with a built-in profit of 100 rubles. on any move that wins. So that when the losing streak is interrupted by a victory, we not only break even and return to the beginning, but also increase by 100 rubles, as if we won the first bet.

- 100 rub.

- 200 rub.

- 400 rub.

It is clear that we just moved one move and then the scheme is the same. Now we only have 9 “Catch-up” steps. On the last full move we will bet 25,600 rubles. to earn 100 rubles. in case of winning. That's 25% of the pot in hopes of winning 0.1%. The reward to risk ratio is huge.

Sports betting is a completely adequate place to apply the Martingale strategy. Unlike online casinos, where algorithms are used to ruin the “catch-ups,” in betting everything depends on the player. The quality of forecasts should be such as to prevent such long negative streaks. The development of this strategy by professionals in specific sports shows that it is extremely rare for a series of even 3-4 losses in a row to occur, not to mention fatal 9-10 defeats in a row.

Let's compare with "Flet" under the same conditions. Average odds 2.00. To stay with his own, the player needs to place at least 50% of positive bets. To save your deposit using the Martingale strategy, a much lower percentage of wins may be acceptable. The main thing is to avoid long losing streaks.

Let me consider one more example. In the past, a coefficient of 2.00, convenient for calculations, was used. Here we will take a more realistic coefficient from practice: 1.80. The rest of the original ones are the same. Starting deposit: 100,000 rub. Since winning the first bet will give 80 rubles. net profit, then we will include this increase in the remaining steps.

- 100 rub.

- 225 rub.

- 507 rub.

- RUB 1,140

- RUB 2,565

- RUB 5,772

- RUB 12,987

- RUB 29,220

Here we have already used 52,516 rubles. Therefore, even putting the entire balance at step 9 will not compensate for previous losses. The lower the coefficients are used, the more airbag you need to have.

Obviously, in practice different coefficients will be used. Here I gave examples using average values to make it easier to calculate and understand the mechanics. To calculate “Dogon” in betting practice, special programs and tables are used, and mathematical models are built.

Advantages

The Matringale strategy works well among professional players who pay great attention to the quality of forecasts and selection of events. If you avoid long series of failures, as illustrated earlier, you can not only keep your bank intact, but also grow confidently.

The algorithm makes it possible to be in the black, or at least on your own, even with a lower percentage of passability than is necessary when playing “Flat”. This is achieved due to the fact that a series of several minuses are won back by one winning bet.

“Dogon” goes well with almost all gaming strategies, except those where the odds are too low.

There are many varieties of Martingale, since the algorithm is very flexible and multifaceted. Therefore, the player can choose the optimal combination of financial plan and gaming models.

Flaws

If we compare the “Flat” and “Dogon” strategies, then their bank growth rate is comparable. During winning bets, profit grows slowly, since a small part of the original deposit is used per iteration. At the same time, the risks of losing your entire account using Martingale are much higher. As was shown in the examples, with those initial steps, 9-11 steps are enough to completely reset the balance. With a larger bet size and lower odds, the loss will happen even faster. With a similar losing streak with Flat, the player loses only 9-11% of the bank, since it does not depend on the seriality of the results.

Limited "Dogon"

As can be seen from the previous examples, the pain point of the “Catch-up” game is long losing streaks. Indeed, it’s ridiculous for the sake of earning 100 rubles. risk a quarter of the bank, for 25,600 rubles, as in the example. For this reason, a cut or limited Martingale is practiced. They do not raise rates until the loss is complete. For example, they set a limit until step 4. If there is no winning before this move, they roll back to the original amount. If the distance cross-country ability is high, then this allows you to compensate for such micro-failures. If you persist and raise to the limit, you can lose the entire bank on one “black streak”.

Martingale strategy for one sporting event

There is an interesting way to apply the “Dogon” strategy within the framework of one sporting event, a match. For example, bets on game sports, on goals (washers) during time periods. The initial forecast assumes that there will be goals. A fixed part of the deposit is allocated for one game. Let's say 1% of the bank. This bet is divided into parts in 3 “Catch-up” moves. In live they bet on a goal in the first 15 minutes. If a goal happens, then the bet wins and moves on to another match. If they lose, then they take the second step with an increase by a goal in the period of up to 30 or 45 minutes, depending on the odds. The third stage will be used in the second half until 75 minutes. This is just one example. Other formations are possible, depending on the sport and the specific market. The good thing about the described approach is that you can’t go far with a series of losses. Having made a maximum of 3-4 increases, within the amount allocated for the match, no further increase is made. They simply switch to another sporting event.

Conclusion

The Martingale strategy is very promising if used skillfully. Before a beginner applies this progressive model of bank management, it is worth testing his skills as a forecaster on a long series of Flat bets. If streaks of more than 3-4 losses in a row do not happen to you, then you can move on to Martingale. This is not a guarantee that such “black streaks” will not happen in the future. But it’s entirely possible to bet this way if you really understand your chosen sport and gaming strategy. If this is not the case, loss will be inevitable, regardless of the chosen financial strategy. It’s just that “Dogon” empties the banks of unlucky forecasters much faster than “Flet”. This must be understood and this scheme must be applied intelligently.