Continuous interest rate formula. Compound and continuously compounded interest

When simple interest is calculated multiple times, the calculation is made in relation to the original amount and represents the same amount each time. In other words,

P - original amount;

S - accrued amount (original amount plus accrued interest);

i - interest rate expressed in shares;

n is the number of accrual periods.

In this case, we talk about a simple interest rate.

When charged multiple times compound interest each time the accrual is made in relation to the amount with interest already accrued earlier. In other words, S= (1 + i) n P

In this case they talk about compound interest rate.

The following situation is often considered. The annual interest rate is j, and interest is calculated m times a year at a compound interest rate of j/m (for example, quarterly, then m = 4, or monthly, then m = 12). Then the formula for the accumulated amount will look like:

![]()

In this case they talk about nominal interest rate.

Sometimes they consider the situation of the so-called continuously accrued interest, that is, the annual number of accrual periods m tends to infinity. The interest rate is denoted by δ, and the formula for the accrued amount is:

In this case, the nominal interest rate δ is called growth force.

Real and nominal rates

There is a distinction between nominal and real interest rates.

Real interest rate is the interest rate adjusted for inflation. The relationship between real, nominal rates and inflation is generally described by the following (approximate) formula:

i r = i n − π

i n - nominal interest rate; i r - real interest rate;

π - expected or planned inflation rate.

Irving Fisher proposed a more accurate model of the relationship between real, nominal rates and inflation, expressed by the Fisher formula named after him:

![]()

For small values of the inflation rate π, the results differ little, but if inflation is high, then the Fisher formula should be used.

Compound Interest Formula

In financial practice, a significant part of calculations is carried out using a compound interest scheme.

The use of a compound interest scheme is advisable in cases where:

Interest is not paid as it accrues, but is added to the original amount owed. Adding accrued interest to the amount of debt, which serves as the basis for their calculation, is called capitalization percent.

If interest money is not paid immediately as it accrues, but is added to the original amount of the debt, then the debt is thus increased by the unpaid amount of interest, and subsequent interest accrual occurs on the increased amount of debt:

S= P+ I = P + P i = P (1 + i) – for one accrual period;

S = (P + I) (1 + i) = P ( 1 + i) ( 1 + i) = P (1 + i) 2

– for two accrual periods; from here, beyond n accrual periods, the formula will take the form: S=P (1 + i)n=P kn, Where

S– increased amount of debt;

P– initial amount of debt;

i– interest rate in the accrual period;

n– number of accrual periods;

k n– coefficient (multiplier) of compound interest accumulation.

This formula is called the compound interest formula.

The difference between the calculation of simple and compound interest is in the basis for their calculation. If simple interest is always calculated on the same original amount of debt, i.e. The accrual base is a constant value, then compound interest is accrued on a base that increases with each accrual period. Thus, simple interest is inherently an absolute increase, and the formula for simple interest is similar to the formula for determining the level of development of the phenomenon being studied with constant absolute increases. Compound interest characterizes the process of growth of the initial amount with a stable growth rate, while increasing it in absolute value with acceleration; therefore, the compound interest formula can be considered as determining the level based on stable growth rates.

According to the general theory of statistics, to obtain the base growth rate, it is necessary to multiply the chain growth rates. Since the interest rate for the period is a chain growth rate, the chain growth rate is equal to: (1 + i).

Then the basic growth rate for the entire period, based on a constant growth rate, has the form: (1 + i)n.

Basic growth rates or coefficients (multipliers) of increase, depending on the interest rate and the number of periods of increase, are tabulated and presented in Appendix 2. The economic meaning of the increase multiplier is that it shows what one monetary unit will be equal to (one ruble, one dollar etc.) through n periods at a given interest rate i.

For short-term loans, simple interest is preferable to compound interest; for a period of one year there is no difference, but for medium-term and long-term loans the accumulated amount calculated using compound interest is significantly higher than using simple interest.

For any i,

if 0< n < 1, то (1 + ni) > (1 + i)n ;

If n> 1, then (1 + ni) < (1 + i)n ;

If n= 1, then (1 + ni) = (1 + i)n .

Thus, for persons providing credit:

A simple interest scheme is more profitable if the loan term is less than a year (interest is charged once at the end of the year);

A compound interest scheme is more profitable if the loan term exceeds one year;

Both schemes give the same result with a period of one year and a one-time interest charge.

Example 1. An amount of 2,000 rubles is loaned for 2 years at an interest rate of 10% per annum. Determine the interest and the amount to be repaid.

Solution:

Accrued amount

S=P (1 + i)n= 2"000 (1 + 0.1) 2 = 2"420 rub.

S=Pk n= 2"000 1.21 = 2"420 rub.,

Where k n = 1,21

Amount of accrued interest

I =S-P= 2"420 - 2"000 = 420 rub.

Thus, after two years it is necessary to return the total amount of 2,420 rubles, of which 2,000 rubles. is a debt, and 420 rubles. - "price of debt".

Quite often, financial contracts are concluded for a period other than a whole number of years.

In cases where the term of a financial transaction is expressed in a fractional number of years, interest can be calculated using two methods:

-general The method consists of direct calculation using the compound interest formula:

S=P (1 + i)n, n=a+b,

Where n– transaction period;

a– an integer number of years;

b– fractional part of the year.

-mixed The calculation method assumes using the compound interest formula for an integer number of years of the interest calculation period, and the simple interest formula for the fractional part of the year:

S=P (1 + i)a (1 + bi).

Because the b < 1, то (1 + bi) > (1 + i)a, therefore, the accumulated amount will be greater when using a mixed scheme.

Example 2. A loan was received from the bank at 9.5% per annum in the amount of 250 thousand rubles. maturing in two years and 9 months. Determine the amount that must be repaid at the end of the loan term in two ways.

Solution:

General method:

S= P (1 + i)n= 250 (1 + 0.095) 2.9 = 320.87 thousand rubles.

Mixed method:

S= P (1 + i)a (1 + bi) =

250 (1 + 0,095) 2 (1 + 270/360 0,095) =

321.11 thousand rubles.

Thus, according to the general method, the interest on the loan will be

I = S - P= 320.87 - 250.00 = 70.84 thousand rubles,

and using a mixed method

I = S - P= 321.11 - 250.00 = 71.11 thousand rubles.

As you can see, the mixed scheme is more beneficial to the lender.

Continuous interest is a term in theoretical economics that implies constant, systematic compounding of interest. If you delve into the basics of economic theory, then continuous interest is accrued at intervals that tend to the smallest number. That is, continuous interest is accrued continuously, but for the convenience of calculation, entrepreneurs or economists say that this or that amount is accrued per second, per hour or day. For example, Bill Gates' income can be called continuous interest income. Theoretic economists have calculated that Bill Gates, one of the richest people in the world, earns approximately $6,600 every minute - this is the amount of continuous interest from his business and investments that is converted into.

The meaning of continuous interest in theoretical and practical economics

Speaking about the importance of continuous interest, it should first be noted that they are a key form of passive income. In essence, passive income consists of two theoretical components: an asset that works without the intervention of an entrepreneur, and the continuous interest that it gives on the amount invested in it. For example, I bought an apartment for 10,000,000 rubles and rents it out at a price of 40,000 rubles per month - this is passive income. The annual income will be 480,000 rubles, from ten million this is 4.8 percent. It turns out that the entrepreneur continuously receives 4.8 percent per annum of the invested amount, this is his annual interest.

The second meaning is that continuous percentages indicate a stable situation in the development of a particular company. If it constantly brings interest, then it is working normally. If the receipt of interest is suspended, it can be judged that problems have occurred in the company. If interest rates rise and fall, this also indicates internal problems of the enterprise. Therefore, in the theory of economic analysis, continuous interest is very important.

The second meaning is that continuous percentages indicate a stable situation in the development of a particular company. If it constantly brings interest, then it is working normally. If the receipt of interest is suspended, it can be judged that problems have occurred in the company. If interest rates rise and fall, this also indicates internal problems of the enterprise. Therefore, in the theory of economic analysis, continuous interest is very important.

The third value we will pay attention to is return on investment. The summation of continuously incoming interest will ultimately lead to the fact that investments in a business will pay off one hundred percent, that is, the entrepreneur will receive back the invested funds and will only have to receive. In economic theory there are many calls for analyzing various factors of economic life (inflation rates and so on) and comparing the results with continuous percentages. It may turn out that the income from the company, expressed as a percentage, will be lower than the percentage of depreciation of money and the like. If, for example, a person receives five percent per year from a deposit in a bank, and the amount is equal to eight percent, then ultimately the depositor loses three percent of his capital. Most people do not pay attention to this, which is a major economic mistake and the cause of many bankruptcies. This is especially important during periods of economic restructuring and disasters.

Stay up to date with all the important events of United Traders - subscribe to our

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

Federal Agency for Education and Science

State educational institution of higher education

vocational education

Tambov State University named after G.R. Derzhavina

on the topic: “Actions with continuous interest”

Performed

5th year student, group 502

Full-time education Geghamyan M.A.

Tambov 2013

1. Constant growth force

2. Variable growth force

6. References

1. Constant growth force

When using a discrete nominal rate, the accrued amount is determined by the formula:

When moving to continuous percentages we get:

Increase multiplier for continuous interest capitalization.

Denoting the growth force through, we get:

because discrete and continuous rates are functionally related to each other, then we can write the equality of the increment multipliers

Example

To the initial capital 500 thousand rubles. compounded interest - 8% per annum for 4 years. Determine the accrued amount if interest accrues continuously.

Discounting based on continuous interest rates

In formula (4.21) we can determine the modern value

The continuous interest rate used in discounting is called the discount rate. It is equal to the growth force, i.e. used for discounting, discount forces or growth forces lead to the same result.

Example

Define the modern cost of payment, provided that discounting is carried out at a growth rate of 12% and at a discrete complex discount rate of the same size.

2. Variable growth force

Using this characteristic, processes of increasing amounts of money with a changing interest rate are modeled. If the growth force is described by some continuous function of time, then the formulas are valid.

For the accrued amount:

Modern cost:

1) Let the growth force change discretely and take the values: at time intervals, then at the end of the loan period the accumulated amount will be:

If the growth period is equal to n, and the average growth value is: , then

Example

Determine the accrual multiplier for continuous compounding of interest for 5 years. If the growth force changes discretely and corresponds to: 1 year -7%, 2 and 3 - 8%, last 2 years - 10%.

2) The growth force changes continuously over time and is described by the equation:

where is the initial growth force (at)

a - annual increase or decrease.

Let's calculate the degree of the increase multiplier:

Example

Initial value growth force is 8%, the interest rate is continuous and changes linearly.

The increase per year is 2%, the growth period is 5 years. Find the growth factor.

3) The growth force changes exponentially, then

Growth multiplier:

Example

Determine the increment multiplier with continuous compounding of interest for 5 years, if the initial growth rate is 10%, and the interest rate increases annually by 3%.

The loan term is determined by the formulas:

When increasing at a constant rate

When increasing at a changing rate, when it changes in geometric progression

Example

Determine the time required for increasing the initial rate by 3 times when accrued at a continuous interest rate changing with a constant growth rate, if the initial rate is 15% and the annual growth rate is 1.05

3. Equivalence of interest rates

Rates that ensure equivalence of financial consequences are called equivalent or relative.

Equivalence of financial consequences can be ensured if there is equality in the increase multipliers.

If in expressions

1) simple interest rate

2) accrued amount at the discount rate

If, then the increment factors are equal

If the loan term is less than a year, then equivalence is determined for two cases of equal time bases and different time bases.

If the time bases are the same (), then the formulas look like:

If interest is calculated at rate i with a base of 365, and at rate d with a base of 360, then the following is true:

Example

The bill was accounted for by the bank discount rate of 8% on the expiration date of its circulation = 200 (k=360). Determine the profitability of this operation at the simple interest rate (k=365).

Equivalence of simple and compound interest rates

When interest is calculated once a year, it is determined by the formulas:

Simple bet:

Complex bet:

Example

What compound annual rate can replace the simple rate of 18% (k=365) without changing the financial consequences. The duration of the operation is 580 days.

Equivalence of a simple interest rate and a compound rate.

When calculating m times a year, it is determined by the formula:

Example

When developing contract terms The parties agreed that the loan yield should be 24%. What should be the size of the nominal rate when interest is calculated monthly, quarterly.

The equivalence of the simple discount rate and the compound interest rate is determined by the formula:

The equivalence of the nominal compound interest rate when interest is calculated m times a year and the simple discount rate is determined by the formulas:

The equivalence of complex bets is determined by the formulas:

The equivalence of the compound discount rate and the nominal compound interest rate when interest is calculated m times a year is determined by the formulas:

Equivalence of continuous and discrete rates:

Equivalence of growth force and nominal rate:

With a discrete and linear change in force growth, as well as if it changes at a constant rate, the equivalent relationship with compound interest rates can be expressed by the formulas:

The equivalence of the growth force and discount rates for a constant discount rate is determined by the formulas:

For a complex discount rate:

Comment. Using formulas for the equivalence of discrete and continuous rates, it is possible to present the results of applying continuous interest in the form of generally accepted characteristics.

4. Average values in financial calculations

For several interest rates, their average is the equivalent value. If the amounts of loans received are equal to each other, then the average interest rate for simple interest is calculated using the weighted average formula with weights equal to the time periods during which this rate was in effect.

Comment. Replacing all averaged rate values with the average interest rate does not change the results of compounding or discounting:

Example

During the year, the company received 2 equal-sized loans of 500 thousand rubles. every. 1 loan for 3 months at 10% per annum. 2 loan - for 9 months at 16% per annum. Determine the average interest rate, check the result by calculating the accrued amounts.

When receiving loans of different sizes issued at different interest rates, the average rate is also calculated using the weighted average formula with weights equal to the products of the amounts of loans received and the terms they were issued.

The average simple discount rate of the discount rate is calculated using the formula:

The average compound interest rate is determined by the formula:

When analyzing the work of credit institutions, the following indicators are calculated: the average loan size, its average duration, the average number of loan turnovers and other indicators.

The average size of one loan, excluding the number of turnovers per year, is calculated using the formula:

Taking into account the number of revolutions per year according to the formula:

where is the number of revolutions,

Length of period

K is the number of clients who received loans.

The average size of all loans, taking into account the number of turnovers per year, shows the outstanding balance of all loans for the year. It is equal to the average size of one loan, taking into account turnover per year, multiplied by the number of clients who received the loan:

where is the total turnover, i.e. the amount of repaid loans repaid during the period.

The average balance of all loans, taking into account the number of turnovers per year, is determined by the formula of the average chronological moment series according to the monthly balance sheets of the credit institution that issued the loan according to the formula:

where is the monthly balance of issued loans.

The number of turnovers of individual loans, subject to their continuous turnover during the period under study, is determined as the quotient of dividing the duration of the period by the term of the loan.

The average number of turnovers of all loans for the period, provided that their continuous turnover occurs, is calculated using a formula based on the availability of data.

The average loan term of individual loans or all loans as a whole is calculated using various formulas

equivalence conversion discounting rate

5. Financial equivalence of obligations and conversion of payments

Replacing one monetary obligation with another or combining several payments into one is based on the principle of financial equivalence of obligations.

Equivalent payments are considered to be payments that, when brought to the same point in time, turn out to be equal. It follows from the accumulation and discounting formulas. Two amounts are considered equal if their modern values at one point in time are the same; with an increase in the interest rate, the sizes of modern values decrease. The rate at which is called critical or barrier. It is derived from equality.

In the case of a compound interest rate, the barrier rate is calculated using the formulas:

The principle of financial equivalence applies to various changes in the conditions for payment of monetary amounts. A general method for solving such problems is to develop an equivalence equation in which the amount of replaced payments reduced to a certain point in time is equated to the amount of payments under the new obligation reduced to the same date. For short-term obligations, simple is used, for medium and long-term - complex.

One of the common cases of changing the terms of contracts is consolidation, i.e. consolidation of payments. There are 2 possible formulations of the problem:

1) A deadline is given and you need to find the amount of payment;

2) The amount of the consolidated payment is given; its term must be determined.

When consolidating several payments into one, provided that the term of the new payment is longer than the previously established term, the equivalence equation is written as:

Where is the accumulated amount of the consolidated payment,

Payments subject to consolidation

Time intervals between and:

In general, the amount of the consolidated payment will look like:

Amounts of combined payments, terms of repayment of which are less than the first term; - amounts of combined payments with terms exceeding the new term.

When consolidating bills, the discount rate is taken into account and the amount of the consolidated payment is determined by the formula:

When consolidating payments using a compound interest rate, the consolidated amount is found using the formulas:

If the amount of the consolidated payment is known and it is necessary to determine the period of its consolidation, maintaining the principle of equivalence:

where is the consolidated amount of the modern payment. If the partners agree to consolidate payments without changing the total amount of payments, then the term of the consolidated payment:

To calculate the deadline for payment of consolidated payments, discount rates can be used, then calculations are made using the formula:

When using compound interest, the formulas look like:

Bibliography

1. Kochovic E. Financial mathematics: Theory and practice of financial and banking calculations. - M.: Finance and Statistics, 2004

2. Krasina F.A. Financial calculations - Financial calculations: textbook / F. A. Krasina. -- Tomsk: El Content, 2011.

3. Selezneva N.N., Ionova A.F. Financial management. Tasks, situations, tests, schemes: Proc. manual for universities. - M.: UNITY-DANA, 2004. - 176 p.

Posted on Allbest.ru

Similar documents

The modern value of ordinary annuity. Determination of the interest rate of financial rent. Mathematical and bank discounting. Equivalence of interest rates and average rates. Calculation of accrued amounts in conditions of inflation. Consolidation of payments.

test, added 11/28/2013

The principle of constructing the interest rate equivalence equation. Determination of the simple interest rate and the effective rate of compound decursive interest. Break-even change in contract terms when combining payments and postponing payment terms.

presentation, added 03/25/2014

Interest rates, their types and calculation methods. Accounting for taxes and inflation in calculations. Equivalence of two amounts. Payment ceiling and its parameters. Average values in financial calculations. Transition from a theoretical time scale to a calendar one and vice versa.

lecture, added 10/25/2012

Methodology for determining the payment amount using compound interest rates. Calculation of the profitability of the operation for the lender in the form of a simple, complex interest and discount rate. Calculation of the preferred investment option at given interest rates.

test, added 03/26/2013

Formation of discount rates. Advantages and disadvantages of methods for their calculation. Risky and risk-free assets, their impact on interest rates. Capital asset valuation model. Select adjustments for the selected discount rate.

course work, added 09/24/2012

Replacement of obligations on the principle of financial equivalence before and after a change in contract. Equivalent interest rate and its calculation for different rates and interest calculation methods. Debt consolidation. Tasks on calculating effective interest rates.

test, added 02/08/2010

Theoretical foundations of financial and commercial calculations: simple and compound interest. Comparison of growth at complex and simple interest rates: variable rates, discounting, consumer credit. The influence of inflation on the modern exchange rate.

course work, added 12/14/2011

Determination of the bill amount, interest rate equivalent to the bank discount rate. Calculation of real annual yield on bonds at a given nominal interest rate and inflation rate. The expected real return of the note holder.

test, added 12/21/2012

The essence of loan interest. Types of interest rates - nominal and real rates. Factors that determine differences in interest rates. Bank interest and interest income. Methods of regulating interest rates by the state and banks.

course work, added 03/16/2008

Factors influencing the foreign exchange market. The connection between an acceptable loan rate and the company’s performance. Discounting cash flows, types of rates. The role of precious metals in the country's foreign exchange reserves. Definition of futures and options contracts.

For continuous interest there is no difference between the interest rate and the discount rate, since the growth rate is a universal indicator. However, along with a constant growth rate, a variable interest rate can be used, the value of which changes according to a given law (mathematical function).

Continuous compounding is used in the analysis of complex financial problems, such as the rationale and selection of investment decisions. When assessing the work of a financial institution where payments are received multiple times over a period, it is advisable to assume that the accumulated amount changes continuously over time and apply continuous interest calculation.

All the situations that we have considered so far relate to discrete interest, since they are calculated over fixed periods of time (year, quarter, month, day, hour). But in practice there are often cases when interest accrues continuously, for an arbitrarily short period of time. If interest were accrued daily, then the annual compounding coefficient (multiplier) would look like this:

k n = (1 + j / m)m = (1 + j / 365) 365

But since interest accrues continuously, then m tends to infinity, and the coefficient (multiplier) of the increase tends to e j:

Where e≈ 2.718281, called the Euler number and is one of the most important constants in mathematical analysis.

From here we can write the formula for the accrued amount for n years:

FV = PV e j n = P e δn

The continuous interest rate is called force of interest and is designated by the symbol δ , in contrast to the discrete interest rate ( j).

Example. A loan of $100 thousand was received for a period of 3 years at 8% per annum. Determine the amount to be repaid at the end of the loan term if interest accrues:

a) once a year;

b) daily;

c) continuously.

Solution:

We use the formulas for discrete and continuous percentages:

accrual once a year

F.V.= 100"000 (1 + 0.08) 3 = 125"971.2 dollars;

daily interest accrual

F.V.= 100"000 (1 + 0.08 / 365) 365 3 = 127"121.6 dollars

continuous interest accrual

F.V.= 100"000 e 0.08 3 = 127"124.9 dollars.

12. Calculation of the loan term:

In any simple financial transaction there are always four values: the modern value ( PV), accumulated or future value ( F.V.), interest rate ( i) and time ( n).

Sometimes, when developing the terms of a financial transaction or analyzing it, it becomes necessary to solve problems related to determining missing parameters, such as the term of the financial transaction or the level of the interest rate.

As a rule, financial contracts necessarily specify terms, dates, and interest accrual periods, since the time factor plays an important role in financial and commercial calculations. However, there are situations when the term of a financial transaction is not directly specified in the terms of the financial transaction, or when this parameter is determined when developing the terms of the financial transaction.

Usually term of financial transaction determined in cases where the interest rate and the amount of interest are known.

If the period is determined in years, then

n = (FV - PV) : (PV i),

and if the transaction period must be determined in days, then the time base appears as a factor:

t = [(FV - PV) : (PV i)] T.

Just like for simple interest, for compound interest it is necessary to have formulas that allow you to determine the missing parameters of a financial transaction:

- loan term:

n = / = / ;

- compound interest rate:

Thus, increasing the deposit three times over three years is equivalent to an annual interest rate of 44.3%, so placing money at 46% per annum will be more profitable.

13. Calculation of the loan term:

14. Interest rate calculation:

- when increasing at a compound annual rate of %,

- when increasing at a nominal rate of % m times a year,

- when increasing by constant growth force.

15. Interest rate calculation:

- when discounted at a complex annual discount rate,

- when discounting at a nominal discount rate m times a year.

2.2.3. Variable interest rate

It should be noted that the basic compound interest formula assumes constant interest rate throughout the entire interest accrual period. However, when providing a long-term loan, compound interest rates that vary over time, but are fixed in advance for each period, are often used. In case of use variables interest rates, the accumulation formula is as follows:

Where ik– time-consistent interest rates;

nk– the duration of the periods during which the corresponding rates are used.

Example. The company received a bank loan in the amount of $100,000 for a period of 5 years. The interest rate on the loan is set at 10% for the 1st year, for the 2nd year an increase in the interest rate is provided in the amount of 1.5%, for subsequent years 1%. Determine the amount of debt to be repaid at the end of the loan term.

Solution:

We use the formula for variable interest rates:

FV = PV (1 + i 1)n 1 (1 + i 2)n 2 … (1 + ik)nk =

100"000 (1 + 0,1) (1 + 0,115) (1 + 0,125) 3 =

174"632.51 dollars

Thus, the amount to be repaid at the end of the loan term will be $174,632.51, of which $100,000 is the direct amount of the debt, and $74,632.51 is interest on the debt.

2.2.4. Continuous accrual of interest

All the situations that we have considered so far relate to discrete interest, since they are calculated over fixed periods of time (year, quarter, month, day, hour). But in practice there are often cases when interest accrues continuously, for an arbitrarily short period of time. If interest were accrued daily, then the annual compounding coefficient (multiplier) would look like this:

kn = (1 + j / m)m = (1 + j / 365) 365

But since interest accrues continuously, then m tends to infinity, and the coefficient (multiplier) of the increase tends to ej:

|

|

Where e≈ 2.718281, called the Euler number and is one of the most important constants in mathematical analysis.

From here we can write the formula for the accrued amount for n years:

F.V. = PV e j n = P e δ n

The continuous interest rate is called force of interest and is designated by the symbol δ , in contrast to the discrete interest rate ( j).

Example. A loan of $100 thousand was received for a period of 3 years at 8% per annum. Determine the amount to be repaid at the end of the loan term if interest accrues:

a) once a year;

b) daily;

c) continuously.

Solution:

We use the formulas for discrete and continuous percentages:

accrual once a year

F.V.= 100"000 (1 + 0.08) 3 = 125"971.2 dollars;

daily interest accrual

F.V.= 100"000 (1 + 0.08 / 365) 365 3 = 127"121.6 dollars

continuous interest accrual

F.V.= 100"000 e 0.08 3 = 127"124.9 dollars.

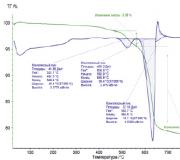

Graphically, the change in the accrued amount depending on the accrual frequency has the following form:

With discrete accrual, each “step” characterizes the increase in the principal amount of the debt as a result of the next accrual of interest. Please note that the height of the “steps” is increasing all the time.

Within one year, one “step” on the left chart corresponds to two smaller “steps” on the middle chart, but in total they exceed the height of the “step” of a single accrual. The increase occurs at an even faster pace with the continuous accrual of interest, which is what the graph on the right shows.

Thus, depending on the frequency of interest accrual, the initial amount is increased at different rates, and the maximum possible increase is carried out with an infinite division of the annual interval.

Continuous compounding is used in the analysis of complex financial problems, such as the rationale and selection of investment decisions. When assessing the work of a financial institution where payments are received multiple times over a period, it is advisable to assume that the accumulated amount changes continuously over time and apply continuous interest calculation

2.2.5. Determining the loan term and interest rate

Just like for simple interest, for compound interest it is necessary to have formulas that allow you to determine the missing parameters of a financial transaction:

loan term:

n = / = / ;

compound interest rate:

Thus, increasing the deposit three times over three years is equivalent to an annual interest rate of 44.3%, so placing money at 46% per annum will be more profitable.

2.3. Rate equivalence and payment replacement

2.3.1. Interest rate equivalence

Quite often in practice a situation arises when it is necessary to compare the profitability of the conditions of various financial transactions and commercial transactions. The conditions of financial and commercial transactions can be very diverse and not directly comparable. To compare alternative options, the rates used in the terms of the contracts result in a uniform figure.

Equivalent interest rate- this is the rate that for the financial transaction in question will give exactly the same monetary result (accumulated amount) as the rate applied in this transaction.

A classic example of equivalence is the nominal and effective interest rates:

i = (1 + j / m)m - 1.

j = m[(1 + i) 1 / m - 1].

The effective rate measures the relative income that can be received for the year as a whole, i.e. it makes absolutely no difference whether to apply the rate j when calculating interest m once a year or annual rate i, – both rates are financially equivalent.

Therefore, it does not matter at all which of the given rates is indicated in the financial conditions, since using them gives the same accrued amount. In the United States, the nominal rate is used in practical calculations, while in European countries they prefer the effective interest rate.

If two nominal rates determine the same effective interest rate, then they are said to be equivalent.

Example. What would be the equivalent nominal interest rates with semiannual compounding and monthly compounding if their corresponding effective rate were to be 25%?

Solution:

We find the nominal rate for semi-annual interest accrual:

j = m[(1 + i) 1 / m - 1] = 2[(1 + 0,25) 1/2 - 1] = 0,23607.

Find the nominal rate for monthly interest calculation:

j = m[(1 + i) 1 / m - 1] = 4[(1 + 0,25) 1/12 - 1] = 0,22523.

Thus, nominal rates of 23.61% compounded semiannually and 22.52% compounded monthly are equivalent.

When deriving equalities connecting equivalent bets, the increment multipliers are equated to each other, which makes it possible to use the equivalence formulas for simple and complex bets:

simple interest rate:

i = [(1 + j / m)m n - 1] / n;

compound interest rate:

|

|

Example. It is intended to place capital for 4 years either at a compound interest rate of 20% per annum with semi-annual compounding, or at a simple interest rate of 26% per annum. Find the best option.

Solution:

We find the equivalent simple rate for the compound interest rate:

i = [(1 + j / m)m n - 1] / n = [(1 + 0,2 / 2) 2 4 - 1] / 4 = 0,2859.

Thus, the simple interest rate equivalent to the compound rate under the first option is 28.59% per annum, which is higher than the proposed simple rate of 26% per annum under the second option, therefore, it is more profitable to place capital under the first option, i.e. at 20% per annum with semi-annual compounding.