What to do if your current account is blocked? What to do if the tax office “blocked” accounts.

One of the most discussed topics in the business community in the past year is the blocking of accounts by banks. At least 500 thousand entrepreneurs faced this problem in a year. A bank account can be blocked for almost anything, and returning to normal service is often only possible through a lengthy legal appeal procedure.

Why do massive blockings of business accounts occur and how to avoid it? Rusbase has collected real stories of entrepreneurs and expert advice.

“The situation is causing indignation”

The Business Russia organization has calculated that since the beginning of the year, banks in the country have blocked at least half a million accounts. That is, 500 thousand companies and entrepreneurs stopped making and accepting payments and were unable to conduct their business normally. Business Ombudsman Boris Titov has already intervened in the situation, saying that back in October he received at least two requests a week related to extrajudicial blocking of bank accounts. The Commissioner for Entrepreneurs' Rights approached the Central Bank with a proposal to create a clear mechanism for excluding organizations from the “black list”.

The list of organizations and entrepreneurs who, for one reason or another, have been refused service by banks, is compiled by the Central Bank based on information from Rosfinmonitoring. It is sent to credit institutions, which at their own discretion refuse to provide services to those on the list.

One of the entrepreneurs who apparently ended up on this “black list” was Petr Kondaurov, founder of the Petr Kondaurov Reengineering Studio. He was serviced by Tinkoff Bank and until recently was quite pleased. All payments to Kondaurov’s company were transparent and supported by relevant documents.

But one day the businessman received an SMS from the bank demanding to close the account and withdraw funds. According to the entrepreneur, the employees did not explain to him the reason for this decision. The companies were simply left with no choice - after paying a decent commission, the money had to be transferred to another bank. The business suffered losses and problems arose with counterparties.

Petr Kondaurov

The overall situation is causing fear and resentment. When you can be deprived of the opportunity to run a business without trial or investigation. When your finely tuned machine of relationships with clients and performers, which feeds your family and children, can be shut down on the basis of suspicion alone at a time when you did not violate any laws or rules, without the right to even justify yourself and prove your non-involvement in fraud and terrorist activities actions.

According to entrepreneurs who have faced blocking of their current account, banks often do not explain anything. Being included in the “black list” becomes something of a stigma for companies: most likely, they will not open an account in other banks either.

Petr Kondaurov

Founder of Peter Kondaurov's Reengineering Studio

A bank without a trial can blacklist you under 115-FZ, and then not a single bank will open an account for you, effectively depriving you of the opportunity to legally earn money. What to do then? It’s a pity that there aren’t enough IPs to organize protests. Before the elections, I think they would have been listened to.

Now the entrepreneur is looking for another bank and hopes that they will first sort it out and negotiate, and not close the account without listening to the client’s arguments.

Anyone can be blocked

The reason for the surge in account blocking in 2017 was new recommendations issued by the Central Bank of Russia. The lengthy document describes the signs on the basis of which banks can identify “suspicious” actions of legal entities. Here are just a few of them:

- transit nature of funds transfers;

- payment of taxes in the amount of less than 0.9% of turnover on the current account, operations aimed at minimizing the tax burden;

- no wages are paid from the account;

- account balances are not comparable with turnover;

- there is a contradiction between the basis of payments, costs and activities of the organization;

- there are no payments within the client’s business activities (rent payments, utilities, etc.);

- more than 30% of cash turnover;

- less than 2 years have passed since the date of creation of the legal entity;

- regular cash withdrawals, usually in an amount not exceeding 600 thousand rubles and using corporate bank cards.

That is, as you can see, it is quite difficult to avoid at least one of the listed “violations”. Therefore, almost all entrepreneurs have the risk of being blocked.

Senior partner at the law firm Titov, Kuzmin and Partners, Andrey Kuzmin, believes that the banks’ desire to play it safe led to mass blocking. In general, the legal basis for extrajudicial blocking of an account is Federal Law No. 115 “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism.” Based on this law, Rosfinmonitoring compiles its “black list”, which includes companies convicted of illegal transactions - financing terrorism and money laundering. It is impossible to get on this list by chance, since the reasons must be quite serious. The vast majority of entrepreneurs face blocking for other reasons. They are described in the very new recommendations of the Central Bank. But the banks took them not as a recommendation, but as a guide to action. And they began to block everyone, “just in case.”

Andrey Kuzmin

Senior partner

"Titov, Kuzmin and partners"

There is no way to avoid claims 100%. Even our law office once had questions when we were paying dues to the Bar Association. Sometimes harmless operations cause suspicion. Thus, one of our clients had their operation to pay bonuses to employees blocked. It happens that transactions involving the purchase of expensive objects, such as equipment or real estate, cause suspicion.

Editor of the Bankir.ru portal Elena Gosteva agrees that the Central Bank’s recommendations contain points that, if interpreted appropriately, provide grounds for blocking the account of any company:

Elena Gosteva

Editor of Bankir.ru

The most common cases of blocking are when one type of activity is specified in the company’s statutory documents, but the payment comes for completely different services. For example, your charter says: “production of dumplings,” and the payment comes for the provision of consulting services. And the bank will not care that you, as an entrepreneur, advised someone specifically on the issue of dumpling production.

The founder of the company that develops the service for retail trade i-Retail, Kirill Voytsekhovich-Kazantsev, says that not only many of his clients, but also he himself have encountered blocking of accounts. From the negative experience, the entrepreneur made a disappointing conclusion: it is almost impossible to prove that he is right to the banks, and you can unblock an account only if you have influential connections in the bank itself:

Kirill Voitsekhovich-Kazantsev

Founder

If an account is blocked, there is practically no chance to defend your case... If financial monitoring for some reason does not like the operations of a legal entity, the account can be blocked absolutely out of nowhere, most often motivating this with simple suspicion. This is a very convenient formulation when there are no obvious signs of violations and there is no need to explain anything. No one will deal with the entrepreneur, they simply block the account and that’s it.

In his opinion, the worst situation is for Internet entrepreneurs who care about the speed of payments. If a company that works with online orders processes payments quickly, then this alone may put it on the list of suspicious ones. The conservatism of the employees of the supervisory departments themselves also plays a certain role, the businessman believes.

Kirill Voitsekhovich-Kazantsev

Founder

The head of the Komissarov and Partners bar association, Andrei Komissarov, says that banks proceed from the “presumption of guilt” of entrepreneurs:

Andrey Komissarov

Head of the Collegium of Lawyers "Commissars and Partners"

The Central Bank has repeatedly indicated that the presence of a company on the “black list” is not an independent basis for refusing to work with it. However, in fact, there is a presumption of bad faith on the part of the client. In most cases, a company, especially when automating the process, may immediately encounter denials of service under the contract, and banks will not bother to conduct a comprehensive analysis of a specific client operation, as required by the regulator... Almost any company can suffer from the suspension of operations under accounts, closing remote access to the Internet bank and other restrictive measures, often without receiving any warnings, explanations or being content with meaningless language about suspicious transactions.

It turns out that blocking of entrepreneurs' accounts is often associated with subjective factors: the bank simply does not like what you are doing. And if so, it means that entrepreneurs will have to adapt for some time (until the development of an effective unlocking mechanism) and learn to avoid actions that vigilant banks may regard as a reason for inclusion in the “black list”.

How to avoid account blocking

Unconditional blocking of an account, that is, suspension of all banking transactions on it, is possible only if the organization or individual is included in the list of persons involved in extremist activities or terrorism. This is the same “black list” of Rosfinmonitoring, which is published on the agency’s website. Most conscientious entrepreneurs will not find themselves there. But, as we managed to find out, there are many other reasons for refusing to carry out transactions on accounts and subsequent blocking.

According to the rules of most banks, an entrepreneur’s current account is not blocked immediately after a suspicious transaction is detected. To begin with, the bank can suspend the transaction itself or prohibit it from being carried out.

- Suspension of an account transaction is possible if the bank suspects that the transaction is being carried out on a dubious transaction.

- A refusal to carry out a transaction is possible if the client has not confirmed the purity of the transaction. The bank may also ask to terminate the current account agreement - and this, strictly speaking, is also not a blocking.

According to Oleg Kharechko, leading legal adviser at the Alta Via law firm, an entrepreneur can always challenge any action of the bank in court. True, this can take a lot of time:

Oleg Kharechko

Leading legal consultant at Alta Via law firmAny blocking of account transactions made by the bank can be challenged either by filing a complaint with the Central Bank of the Russian Federation or in court. In the latter case, you can not only challenge the actions of the bank, but also sue it for improper execution of the bank account agreement with subsequent recovery of damages caused. For example, a bank has the right to completely block an account for all transactions only if the entrepreneur is on the list of persons involved in extremist activities and terrorism.

In all other cases, complete blocking is possible only by Rosfinmonitoring for a period of a month during an inspection or by court decision. Therefore, if an entrepreneur’s account is blocked, but he is not on the list of prohibited persons, the blocking can be challenged. Difficulties arise mainly due to the fact that legal proceedings last for months, while for a client even a couple of days of delay in a banking transaction can be critical.

Managing Director of Heritage Group Olga Kirillova reminds that banks, as a rule, first send a notice to the entrepreneur and ask to provide documents if a particular operation has raised their suspicions:

Olga Kirillova

Managing Director of Heritage Group

Requests for the provision of documents are sent either by email or through the online banking communication system. These must be collected and submitted as quickly as possible to prevent account blocking. Unblocking an account is a long and difficult procedure, and you will not always be able to prove to the bank that the company is bona fide. It is much easier to prevent such a situation by carefully conducting transactions on your current account.

At the same time, as lawyer Andrei Kuzmin emphasizes, refusal to carry out an operation is also a dangerous phenomenon. “Two refusals in a year - and the bank has grounds for terminating the bank account agreement,” says the lawyer.

To avoid suspicion from the bank, entrepreneurs, according to experts surveyed by Rusbase, need to follow several rules:

- check counterparties and avoid contacts with fly-by-night companies;

- be at a legal address or at least receive mail there;

- pay attention to payment purposes. It should be clear from them what the payment is for;

- moderate cash withdrawals and loans to individuals;

- do not separate current accounts into those from which taxes are paid and those used for main activities;

- the tax burden should be more than 0.9% of turnover.

Regular transfers of money to individuals and individual entrepreneurs, transfers of money to foreign counterparties without simultaneous payment of VAT, and quick write-off of received funds may also seem suspicious. It is considered extremely dangerous to pay bills for third parties. “In this case, blocking occurs instantly,” warns Olga Kirillova.

Natalya Kordyukova, deputy director of the international tax planning department at the Cliff law firm, says that companies that are associated with counterparties - foreign entities, especially from offshore companies or associated with political activities - come under suspicion. Also at risk are those organizations that are not located at the place of registration or do not have a website. Banks pay increased attention to those who work in “dubious” industries: these are betting shops, pawnshops, charitable organizations, companies involved in the trade of precious metals and cars.

The main thing that experts advise is to provide banks with all the information upon the first request. Most likely, having received a legal justification for the “dubious” operation, the bank will allow it to be carried out and will withdraw all claims.

Andrey Kuzmin

Senior partner

"Titov, Kuzmin and partners"

However, sometimes the situation becomes more complicated. For example, the bank sent a request, the documents were provided, but the block was not lifted. In this case, you need to come to the bank office and find out the reasons. It happens that they didn’t even look at the documents. Sometimes you may receive an offer to terminate the bank account agreement by agreement of the parties. As a rule, you should not refuse such offers, since the bank may initiate a forced cancellation of the agreement with the organization being blacklisted.

What the banks say

The owner of the online electronics store Video-Shoper.ru Nikolai Fedotkin also faced blocking of his account. He is a client of a bank that is in the top 10 by assets, which one day blocked the ability to make payments to the company’s current account. According to the entrepreneur, the bank’s specialists did not explain the reasons for the suspension of transactions and did not even accept documents from him that confirm the legality of the business.

“We don’t need any letters or documents from you. We won’t look at anything, your Internet bank is blocked, we don’t give any explanations, you can now only work through the branch on Savelovskaya or you can withdraw your money,”

- Fedotkin quotes the words of employees.

As a result, the entrepreneur was offered to withdraw money from the account with a commission of 25%. And this is 1 million rubles. Another option is to close your current account and transfer funds to a new one. In response, the entrepreneur decided to change the service bank altogether.

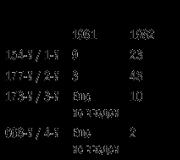

Modulbank recently conducted a study in which it analyzed the main reasons for blocking the accounts of entrepreneurs. It turned out that in 100% of cases the companies fell under two or more criteria of “suspiciousness” listed in the recommendations of the Central Bank. Here are some other findings from this study:

- 70% of companies whose accounts were blocked this year did not pay additional personal income tax based on the results of transfers to individuals;

- 55% of blocked companies withdrew money from their accounts abnormally quickly, without ever delaying it;

- 50% of companies worked with unreliable counterparties;

- 45% of entrepreneurs paid taxes in small amounts, incomparable with the scale and type of business;

- 38% of companies previously came to the attention of Rosfinmonitoring due to problems with service in banks;

- 35% of companies paid insufficient VAT;

- 9% of companies withdrew too much cash.

The bank is obliged to add such a client to the list of so-called “refusers” and inform the regulator about this. But put yourself in the bank's shoes. It is impossible to open an account on formal grounds, and it is also not allowed to refuse a client. Banks found a way out of the situation. The operator will ask you for a large amount of additional documentation, and this will automatically scare away the client. Or he will simply inform you that the application is still pending. And you can receive this status for months until you get tired of waiting and go to open an account at another bank.

The expert advises to be prepared for the bank to ask a lot of questions. Then all that remains is to prove that you are clean before the law. Operating companies can provide tax documentation, detailed accounting, recommendations from counterparties, documents from other banks - everything that will demonstrate law-abidingness and goodwill.

The Central Bank and Rosfinmonitoring, under pressure from the business community, agreed to develop an algorithm for the rehabilitation of companies included in the stop list. Perhaps the mechanism will start operating in 2018.

Olga Kirillova, managing director of Heritage Group: “The problem is that Rosfinmonitoring and the Central Bank have not yet created a mechanism for the rehabilitation of clients who are blacklisted. Because previously the only people on the blacklist were terrorists, drug dealers, arms dealers and slave traders who were not subject to rehabilitation. Amendments to the legislation are now being prepared that could help bona fide companies that have been blacklisted due to the excessive zeal of banks.”

Until then, any company can suddenly find itself among the growing army of blocked ones, even if the business is as transparent as a mountain stream, and the founder is as pure as the Pope. Leading legal adviser at Alta Via, Oleg Kharechko, believes that at this stage, entrepreneurs can only fight for their rights privately - demand that Rosfinmonitoring and the Central Bank remove themselves from the “black list” and hope not to get on it again.

Clients of financial institutions often face blocking of their accounts or transactions that, in their opinion, are completely legal. However, the bank may have a different opinion. Banki.ru found out what criteria can be used to determine that you are at risk and your card or account will soon be blocked.

“I don’t work, but copy documents for Tinkoff Bank”

“Today Sberbank offered me, in a non-alternative form, to explain in writing and secure on paper All transactions in 3 months. The call center operator suggested sending your question by email, attaching the card number and all passport data. When asked about the Federal Law “processing and storage of personal data” with this method of communication, she replied: “Well, don’t send it. Come to the bank and find out everything this way.” Or she suggested that I send an appeal through my personal account, access to which they had previously blocked,” Alexander Tomchenko, CEO of Idealpromo agency, complained on his Facebook page.

“More than 2 months ago, we opened a current account at Tinkoff Bank, everything was fine until the moment we received an SMS that transactions on the account were suspended until the documents were provided. The request arrived on September 20. The next day I sent some of the documents for verification, because the volume was quite large. On Monday the answer came that another part needed to be provided. I sent more. And until today, the account is still frozen. A week has already passed. The organization suffers losses. I understand perfectly well that by law the bank has the right to suspend operations. But it is still possible to verify documents with less discomfort for the client.

Why freeze the account immediately? You will send a message that if the documents are not provided, the account will be stopped. And inspections can be carried out at a more accelerated pace,” wrote one of the users of the “People’s Rating” Banki.ru.

“The story continues to gain momentum. They opened access, but they also demanded a huge package of documents, even those that I already sent. They gave me one day! It's simply impossible to do this anymore. I don’t work, I copy documents for Tinkoff Bank!” - she added later.

Why freeze the account immediately? You will send a message that if the documents are not provided, the account will be stopped. And inspections can be carried out at a more accelerated pace.

Banking financial monitoring services are not stopped even by the client having a priority card.

“I have been using a Sberbank card for more than three years, and I use it actively, I constantly buy something, transfer things, and accumulate miles, since it is an Aeroflot Bonus card. And then suddenly it happened. I came to the store, was going to buy groceries, and the card was blocked without any notifications, SMS messages, etc. Well, okay, I think maybe there’s some kind of mistake, I call the hotline, and the girl tells me that the bank can unilaterally block the card without explaining the reasons, supposedly they don’t like me. Ok, no questions asked! We have a lot of banks - if you want to block them, please. But why put your own client in such an uncomfortable position, why not at least send a message, especially since I pay them regularly! This attitude really upset me! Although they provided priority service, and they increased the credit card limit, but left them without money - thank you very much for your professionalism. We will choose private banks,” a user of the “People’s Rating” told Banki.ru.

“Often the bank is reinsured”

The control system built in a credit organization affects employees at almost all levels, from tellers and cashiers to senior managers. The bank, in turn, reports on the blocking carried out to Rosfinmonitoring.

“Often, a bank plays it safe by blocking transactions and accounts at its own discretion, without sufficient grounds from the client’s point of view. The situation is aggravated by the fact that the organization does not bear any responsibility for the blocking. In fact, banks are abusing their powers under Federal Law 115, acting on the principle “it’s better to be safe than sorry.” In addition, if we are talking about blocking an account in connection with a transaction for a significant amount, then this may be a signal from the bank that you are an unwanted client for it. For example, some banks do not favor clients who receive “gray” earnings into their accounts,” Roman Alekseev, head of the legal department of Castle Family Office in Russia and the CIS, comments on the increasing cases of account blocking.

“In practice, even insignificant amounts can become a reason for the bank to want to say goodbye to you. This is a clear abuse of the provisions of 115-FZ on the part of the credit institution,” the expert notes.

How to avoid card blocking

Several years ago, citizens of the Russian Federation had the opportunity to transfer funds only by indicating the recipient’s account number. To date, transactions using individual cards remain fairly closed to regulatory authorities, however, there are a number of signs that may make them subject to inspection.

The volume of funds turnover by recipient's account number is quite large - in Sberbank alone this figure for the first quarter of 2017 amounted to 2.6 trillion rubles.

Bank and laundry plant

Banks not only help tax authorities in the fight against money laundering, but have also become almost their “understudies,” requiring more information from clients than regulatory authorities. Banki.ru found out what personal information credit institutions want to receive from you and whether this helps fight fraudsters.

Do not close your account after a series of similar transfers

Transactions that attract the attention of banks, accordingly, may become the object of inspection by tax authorities. These include cases when the receipt and receipt of funds occurs on the same business day; the same participants in similar transactions or significant amounts of funds received by an individual from his account, if they are received in one internal division of a credit institution. Also, the bank's attention will be drawn to transactions after which the account is abruptly closed. Or operations that stop after a cycle of similar transfers.

Don't be too careful

It should also be taken into account that attention to the client may be caused by his behavior - excessive precautions to ensure the confidentiality of transactions, as well as refusal to provide information that is requested in accordance with established banking practice. Moreover, the request for such information does not have to be provided for by law - it should simply be requested for the same transactions in the usual manner.

Dangerous amount - 600 thousand rubles

The bank may pay attention to the client’s transactions in a number of other cases - for example, if they do not make economic sense and do not correspond to the nature of its activities. A suspicious factor may be the inability to identify the client's counterparties. The limit of 600 thousand rubles is of great importance - it is when it is reached that you can come into the view of financial control. For example, the crediting of a significant number of payments from individuals to a client’s account, including through the cash desk of a credit institution, may attract attention. The amount of payments may not exceed the equivalent of 600 thousand rubles. The explanation may be the client’s activities, which are related to the provision of services to the public or the collection of any payments.

Don't mess with "non-entrepreneurs"

The most questions are raised by those transfers that citizens make for services provided to them to persons who are not entrepreneurs. The fact is that for recipients such funds are income, which, like any other, is subject to taxation. For residents of the Russian Federation, the tax rate is 13%, for non-residents - 30%. The state can track and receive taxes from such income only if the services are provided on the basis of a formal contract, the funds for which are received already taking into account the payment of VAT.

Try not to evade taxes

Such transactions come to the attention of tax authorities extremely rarely and most often by accident. No mass inspections have yet been carried out against individuals to identify their concealment of taxable income. However, Article 89 of the Tax Code provides, among other things, for the possibility of conducting a tax audit in relation to an individual. The basis for this may be information that indicates possible tax evasion. In theory, a bank can provide such information to the tax authorities (Article 86 of the Tax Code of the Russian Federation), but in practice such interaction does not have pronounced manifestations.

There is practically no judicial practice in such cases, since the tax office simply does not have a mechanism for identifying such offenses. However, freelancers still have certain risks - according to the federal law “On Combating the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism,” a credit institution has the right to request information about the origin of funds.

The bank has such a right if it establishes the fact of regular receipt of funds to the client. If a response is not received, the credit institution has the right to take measures against the client. For example, block an account. It is also worth remembering that if the tax authorities discover undeclared income, the violator will face a fine of 20% of the unpaid tax amount. You can avoid such risks only by officially registering your activities and paying official taxes on them.

Don't rush to withdraw cash quickly and often

Chief analyst of TeleTrade Group Petr Pushkarev recommends that in order to avoid situations with account blocking, do not rush to quickly and often withdraw payments in cash to your account. Especially if a substantial amount has been deposited into your account. It is better to continue using money from your bank account - for non-cash payments in the form of transfers or payments by bank card. “It is precisely such actions with cash withdrawal soon after the next payment that can be similar to the deliberate “cashout” of funds, especially if such payments came from the same legal entity not only to you, but also to other citizens and they behaved similarly: they went and immediately withdrew money in the ATM. In such cases, banking supervision is vigilant,” the expert comments.

Most likely, to unblock an account it will be enough to provide a set of simple supporting documents, such as: an agreement for the provision of a certain type of service with a legal entity; purchase and sale agreement, from which you can see for what goods or services the funds were transferred. If money in the amount of more than 600 thousand rubles came from an individual, then a well-drafted deed of gift or other document, for example a loan agreement, from which it is clear that the person transferred the money to you (or you to him) on certain conditions, repaying the debt, can help .

Most likely, to unblock an account it will be enough to provide a set of simple supporting documents, such as: an agreement for the provision of a certain type of service with a legal entity; purchase and sale agreement, from which you can see for what goods or services the funds were transferred.

Nothing can be done: without providing such documents, the banking transactions of those who launder money look exactly the same as the actions of completely law-abiding people. Their transfers or non-cash purchases do not differ in appearance from ordinary ones. Therefore, in order to follow the law, banking control authorities request additional documents explaining the economic meaning of your actions and the actions of your counterparties.

“If this is a story about an “undesirable” client, then the solution to the problem will be to terminate the contract at your own request and open an account in a more “friendly” bank,” says David Kapianidze, head of the tax practice at BMS Law Firm.

“In this case, the funds from the account will be returned to the client. If the bank for any reason refuses to return/transfer funds, this is a reason to file a complaint with the Central Bank of the Russian Federation. In court, you can recover part of the annual service fee from the bank. It can even be for moral damage. But you shouldn’t count on any gigantic sums,” the expert concludes.

Natalya STRELTSOVA, Banki.ru, David KAPIANIDZE, head of tax practice at BMS Law Firm

In this article we will look at the reasons for blocking a current account by a bank. Let's look at the features of blocking under 115-FZ and the timing of its removal. We will tell you how to remove the block and withdraw your own money to another bank.

Reasons for blocking an account by a bank

Blocking an account involves setting a ban on making expense transactions or seizing a certain amount. It can occur at the initiative of a bank, tax service, other government agencies or on the basis of a court decision. But in any case there must be appropriate grounds.

Here is a list of the most common reasons for blocking:

- Failure to pay taxes, fees, other contributions or failure to submit appropriate reports within established deadlines. Such blocking is established for the purpose of collecting from the taxpayer the amounts required by law.

- Judgment. Seizure of funds is possible during the forced execution of a judicial act on the basis of a bailiff's order, as well as when the court takes interim measures during the consideration of a claim.

- Suspicions about the unit 115-FZ. The state is very active in combating money laundering and other illegal activities aimed at financing terrorism. To solve this problem, banks are required to monitor customer transactions. If there is any doubt that the transaction is legal, payment is suspended. It becomes impossible or difficult to carry out operations before restrictions are lifted. The initiator of blocking under 115-FZ can be Rosfinmonitoring if the operations come into its field of view.

Account blocking by financial monitoring

Business representatives began to face the fact that banks often block the account of an LLC or individual entrepreneur. Federal Law 115-FZ imposes an obligation on credit organizations to monitor the legality of transactions. If suspicion arises, banks require the submission of supporting documents. If blocked at the initiative of Rosfinmonitoring, account operations may be suspended for up to 30 days.

Although the bank itself cannot establish a complete blocking of an account under Russian law, it has all the tools to restrict non-cash transactions for organizations or individual entrepreneurs. If repeated violations are detected, the credit institution may even refuse to provide service to the client.

The bank limits account transactions and requests documents in the following cases:

- The transaction is confusing or has no obvious meaning. If it is difficult to understand the legitimate purposes of the operation and the benefits from it for an entrepreneur or organization, then the bank will require explanations.

- X the nature of the transaction is clearly aimed at cashing out funds, evading taxes or control. A company that conducts transit operations or frequently withdraws funds received from an account will inevitably attract the attention of financial monitoring. The situation will be similar if there is an obvious splitting of the transfer amount in order to avoid control by Rosfinmonitoring.

- The transaction does not correspond to the goals of the organization specified in the constituent documents. For example, if a payment is received into the account of a commercial organization with the intent “for charity,” then questions and control cannot be avoided.

- Other circumstances, based on which it can be assumed that the transaction is aimed at money laundering or terrorist financing. In fact, any suspicion is enough for the bank. This can be caused by a low tax burden on the organization, sending a payment to a suspicious counterparty, etc.

How to find out why your account is blocked

Before taking any action, you need to find out the reason for the blocking. Typically, notification of restrictions is sent to the client through a remote service system. This is exactly what Modulbank, Uralsib Bank and other credit organizations do. This document contains information about what measures must be taken to unblock the account.

If there is no access to Internet banking or it is also blocked, then you can try contacting your manager at the bank. Usually, specialists from Vozrozhdenie Bank, Promsvyazbank, etc. readily answer questions.

For details, your request will have to be submitted in writing. You will need to prepare a corresponding letter on company letterhead and bring it to the office of the credit institution.

How to pay taxes if your account is blocked

The reasons for blocking an account can be very different. If the account is blocked by the tax service due to unpaid taxes, then it is enough to deposit the required amount.

An entrepreneur can send a tax payment from his personal account or pay it in cash at a bank. It is somewhat more difficult for organizations. For a long time, they could pay tax payments exclusively from their current account. But in 2015 the situation changed. Currently, the director of an organization or its representative, acting on the basis of a power of attorney, can pay taxes in cash, for example, at Sberbank or send the corresponding payment from his personal account.

How to unblock a current account

When a blockage is detected on an account, the question immediately arises of what to do in such a situation. The first step is to receive a blocking notification and carefully study it. After this, you can begin to solve the problem. Depending on the situation, you should take the following actions:

- If your account is blocked by the tax service due to unfiled returns, you just need to submit them. If the reporting has already been sent previously, you will have to write a letter about unblocking the current account and attach to it documents confirming sending (postal receipts, confirmation of sending via TKS, etc.). Using a ready-made sample document, preparing your own application will not be difficult at all. SCREEN

- In a situation where an account is blocked by a court, the only solution will be to seek its cancellation. To do this, you need to file an appeal, cassation, etc.

- If the block is set by the bank, then you will have to prepare all the necessary documents that the bank asks for. If the decision on unlocking is negative, you need to provide additional clarification about your activities. But sometimes it is not possible to achieve results even after submitting all the documents. In this case, you can send a claim for illegal blocking to the bank and go to court to protect your interests. In case of official refusal of service, you can also contact the interdepartmental commission created under the Central Bank of the Russian Federation. The bank will also offer you a withdrawal of your money when closing the account at interest (usually from 10 to 25%).

Deadlines for lifting the block

Clear deadlines for lifting blockings are not specified in the legislation for all situations. The tax office will lift the block within a day after the cause is eliminated. This usually happens the next day after submitting the declaration or 3 - 4 days after paying the debt. The bank may review documents in accordance with internal regulations. The unlocking procedure can last up to 1 - 2 months.

How to withdraw money from a blocked account

The bank will not allow you to simply remove the block and transfer money from the blocked account. If a credit institution has set restrictions on transactions, you can withdraw funds to another bank. But in this case, most banks will withhold a commission (10 - 15% of the amount).

Another option for withdrawing funds that allows you to bypass the blocking may be to obtain a court decision or order. Employees who are not paid a salary, a supplier, etc. can sue. If you have good relations with partners or use litigation with an affiliated company, you can withdraw money using this method with virtually no commission. But the big disadvantage will be the length of the process. It will take from 2 to 6 months to receive a court decision and writ of execution. A court order is issued much faster (up to 5 days), but it can result in recovery of no more than RUB 500,000. within the framework of one contract.

Judicial practice on account blocking

When 115-FZ began to be applied, the courts of first instance often sided with the bank, and the businessman was able to prove his case, at best, after an appeal. But now the situation has changed. This category of cases began to gain momentum, and the courts began to take a more responsible approach to decision-making.

If your operations are legal, then the court will definitely side with you. The main thing is to collect all the documents on the transactions that raised questions. The bank will also have to explain its position and confirm it, which is not always easy to do. In a situation where transactions are clearly questionable, the court will most likely refuse. But even in the latter case, the decision may be made in your favor, since it is the bank that has to prove that it had the necessary grounds to block the account.

Why do banks feel free to block accounts of companies, even when there is no reason to do so? And most importantly, what actions will help solve the situation? Kira Gin, managing partner of the law firm Gin and Partners, has figured out the situation and tells what to do.

Real blocking stories

The other day my morning began with a call from an entrepreneur from Yekaterinburg. We know him. In fact, he asked my advice on what to do if the bank blocked his individual entrepreneur account and told me the details. He was served as an individual entrepreneur in one of the banks with state participation, transferred money from his individual entrepreneur account to his personal account, up to a million rubles per month. The bank blocked his account and asked him to tell him what he withdrew and spent money on, and also demanded that he provide supporting documents for his personal expenses.My friend’s answer that he did not break the law and withdrew money for his personal needs was not satisfied by the bank. My friend did not report on his personal expenses (although he could have and, most likely, the bank would have been satisfied). The entrepreneur considered the demands made by the bank to be unreasonable and excessive (he is right here).

His message to the bank that he would go to court did not cool the employees of the state bank, because “they are ready to come to court and laugh.” This is the attitude of banks with state participation towards small and medium-sized businesses today.Since when can an individual entrepreneur not consider the profit his own and put it in his pocket, as well as dispose of the money he earns at his own discretion? The money was earned by an entrepreneur I know absolutely legally...

This story continues. The next day, my friend received a call from his friend, the head of this very state bank in Yekaterinburg, where he is serviced. He said that blocking of accounts is a widespread phenomenon today and in the current situation their friendly relations will not help. As a solution, he suggested quietly moving to another bank. He warned that those who complain to the Central Bank and challenge their rights in court have also been dealt with: entrepreneurs are simply added to the “black lists” of the Central Bank, so that later it will be difficult for them to work legally, much less open bank accounts.

The bank blocked the account of another of our clients and asked us to confirm the nature of the transactions, the origin of the money and the reality of the business. We helped him collect documents that characterize him as a law-abiding businessman with a real business. Now we are waiting for Sberbank to review the collected documents. In the best case, his account will be unblocked, in the worst case, the client will have to switch to another bank or go to court against the bank’s actions.

The reality is this: banking chaos in Russia is gaining momentum. Are your business and you ready for such prospects? These are no longer horror stories, but the business reality in which you and I live.According to the organization “Business Russia”, since the beginning of 2017, Russian.

What to do with all this? Is it possible to get a business account unblocked?

Three ways to solve the problem

If your account is blocked by the bank, you have three ways to solve this situation.First way: just close one account and withdraw funds to another account in another bank. This option will most likely completely suit the bank, since it sees you as an undesirable client who violates Law No. 115-FZ; other people’s problems are not needed by anyone at the bank, especially in difficult times of deprivation of licenses.

In addition to the troubles from the very fact of blocking your account, banks (but not all) also add negativity. They began to take advantage of the client’s vulnerable position (this is not legal, Rosfinmonitoring did not give such powers to the bank, but there is no direct ban on this type of trick). The most typical situation: the bank blocked the account(following the instructions of Rosfinmonitoring) and kindly informs the taxpayer that he can transfer his money to another account in another bank for a certain bribe (thus introducing a protective tariff) - they ask for this service from 7 to 15 percent of the amount that is on the account at the bank client. You can file a complaint against such illegal actions of the bank to the management of the financial institution and try to part with it without compensation commissions. In addition, the courts recognize that the introduction of such protective tariffs by a bank is illegal, since in essence it is not a commission, but a fine and an attempt to profit from Federal Law 115 instead of monitoring its compliance.

About an unusual way to solve the problem. Companies blocked Internet banking. As a result, it became impossible to get my money back in the amount of 1 million rubles. It is impossible to transfer them to another account, since other banks refuse to open an account. But the servicing bank offers a way out: nominally give him money and...Second way: You can return money from a blocked account using a writ of execution. This, however, will take the time it will take for the trial, but if a creditor friendly to you sues, wins the trial and receives a writ of execution, and then presents it to the bank, then the bank will be obliged to execute it.

Third way.

It is directly provided for by current law No. 115-FZ:

1) Collect and submit documents requested by the bank. These documents must be such as to remove suspicion from you, prove your reliability and payment transactions should not in any way be classified as suspicious in accordance with paragraph 2 of Art. 7 of Law No. 115-FZ.

2) If the bank accepted your documents, but did not want to understand the situation (our clients submitted documents to the bank at 2 a.m., but at 10 a.m. the bank again refused to unblock their account), the account did not unblock - contact the Arbitration Court, demand that the bank’s actions be recognized as illegal and oblige it to carry out the transactions you need. In accordance with Art. 65 of the Arbitration Procedure Code of the Russian Federation, it is the bank that is obliged to prove that it had grounds for suspending or refusing to carry out certain operations on behalf of the client.

Judicial practice is as follows: if your operations are clearly criminal, then you will be denied (but not always - see examples below).

If your transactions are legal, you have submitted supporting documents to the bank, but the bank still behaves strangely and does not change its position, then the court will side with you. Then it will be possible to recover from the bank all losses, interest for the use of other people's funds and legal costs (Articles 15, 395 and 856 of the Civil Code of the Russian Federation).

The author will tell you in detail about how to defend your position in court in the following material. Follow along.

Current accounts are necessary for legal entities and individual entrepreneurs to carry out financial transactions, namely for non-cash payments. Through them, transactions related to business activities are carried out: settlements with partners, payment of salaries, compensation, receipt of payments from clients.

Account blocking is a fairly common situation.

Regardless of the reasons that led to such a result, the entire financial activity of the enterprise is disrupted, many important processes are suspended: it is impossible to withdraw funds for business affairs and make payments on its obligations.

As a result, contractual obligations are violated and the company cannot fully continue its work. Therefore, it is so important to know the common reasons for blocking and the procedure for removing the arrest.

What is a r/s arrest?

The seizure of current accounts involves the complete cessation of transactions involving the expenditure of funds in the account. It becomes impossible to withdraw or transfer money. At the same time, funds continue to arrive on the account in the standard mode. You can't just block an account. You need good reasons for this.

- Seizure may be imposed by the tax service. This is relevant if there are tax arrears, or the Federal Tax Service suspects that the sources of the funds being credited are illegal. The right is set out in Article 72 of the Tax Code of the Russian Federation. This method is considered effective in influencing the debtor. The owner of the enterprise, under the threat of stopping all business processes, will have to pay all taxes.

- Another option for arrest is the presence of debt. Debt itself does not lead to blocking. Freezing of accounts is carried out on the basis of a writ of execution. You can get it through the court. Funds from the account are used to pay off existing debt. If funds are received into the account, they will also be used to offset the debt.

- The banking institution itself can block the account if there are factors indicating that the company is laundering funds. Reasons for suspicion may include large receipts in foreign currency, frequent transfers to individuals or other organizations, transfers to the accounts of persons whose activities are recognized as extremist or terrorist.

List of reasons for blocking an account with the bank itself

Each banking institution has a monitoring service that monitors counterparties and ongoing operations. If violations are recorded, the bank itself can decide to block it. An arrest is imposed in the following circumstances:

- Signs of the presence of a nominee director in the organization were discovered. For example, the status of a director of several companies for one person can be considered such a sign.

- Questionable transactions carried out via cash account. Transactions are considered questionable if they disagree with existing documents or if there are no supporting documents at all. Suspicions may be caused by non-compliance with OKVED codes, incorrect payment, lack of instructions regarding its purposes, situations in which the owner of the enterprise cannot provide transaction agreements.

- The bank was not notified of the changes in the constituent documents. The enterprise is obliged to immediately notify the banking institution of any changes in the constituent documentation. It is also required to send notifications about a change of manager. If there is a discrepancy between the company data and the data stored in the bank, grounds for arrest arise.

- Invalid legal address of the enterprise. A banking institution may well organize an on-site check to determine the validity of the company’s legal address. If the organization is not located at the stated address, the first action of the financial institution is to block the account.

- Debt collection under a writ of execution. If the court has decided to collect the debt by seizing the accounts, the bank will block the accounts after presenting a writ of execution.

Blocking may be carried out for the purpose of financial monitoring. However, in this case, the account is frozen for only 2 days. If the blocking is not lifted after this period, the owner of the account may file a complaint with the National Bank. An alternative option is to file a lawsuit.

What should I do to unblock my account?

The specifics of lifting a seizure depend on the reasons for its imposition:

- If the arrest is imposed due to suspicions about the nominee director, it is required to provide documents challenging this opinion. The director must appear at the banking institution himself with a supporting package of papers.

- If the blocking was carried out due to unapproved changes to the constituent documents, you must provide papers that confirm the adjustments made.

- If the arrest is made due to an invalid legal address, you must provide documents confirming your valid legal address.

- If there is a tax debt, it must be paid in full. Only after this the Federal Tax Service sends a request to the bank that the arrest can be lifted.

- If the blocking was carried out on the basis of a writ of execution, you will also need to pay the entire debt, and then provide documents confirming this.

If your current account is blocked, you must immediately go to the bank and find out the reasons for the arrest. The bank is obliged to provide this information. Only then should you act.

IMPORTANT! Sometimes a personal arrest is imposed illegally. Mistakes can be made not only by the enterprise, but also by tax inspectors and employees of a banking institution. If there are no violations, you should contact the bank and demand clarification. If a banking institution refuses to unlock, you should go to court. Judicial practice in such cases is positive for the plaintiff.

Is it possible to withdraw funds from a seized account?

If the current account is seized, it is impossible to withdraw funds from it. The only way to get money is to correct all violations and contact the bank with a request to unblock it. You need to be prepared for the fact that the process of lifting the arrest is quite lengthy. The simplest situation is blocking by decision of the bank itself. In this case, lifting the arrest is simplified, since the decision is made by only one authority.

The longest process is the unblocking process by decision of a judicial authority or tax service. In these bodies, document flow is quite slow. Even if a person provides all the evidence of payment of the debt, it will still take a lot of time to unblock the account.

Let's summarize

Blocking a bank account is a very likely situation. The banking institution has all relevant powers. Seizure of an account leads to negative consequences for the company. In particular, all financial processes slow down and payments with partners become impossible. For this reason, it is so important to contact the bank in a timely manner, find out the reasons for the blocking and take measures to remove it.